Understanding New York State income tax is crucial for residents, business owners, and anyone earning income in the state. Proper planning and compliance can help you avoid penalties and make the most of your financial situation. This article will provide you with a detailed overview of New York State income tax, including its rates, filing requirements, exemptions, and deductions.

As one of the most populated states in the United States, New York imposes a progressive income tax system on its residents and individuals earning income within its borders. The tax structure is designed to ensure fairness while generating revenue for essential state services. Whether you're an individual taxpayer or a business owner, staying informed about New York State income tax is vital for financial success.

In this article, we'll explore everything you need to know about New York State income tax, including key deadlines, available credits, and common mistakes to avoid. Whether you're a new resident or a long-time taxpayer, our goal is to provide you with actionable insights to simplify your tax obligations.

Read also:Melissa Oneil The Rising Star Of Music And Acting

Table of Contents

Introduction to New York State Income Tax

New York State Income Tax Rates

Filing Status and Requirements

Read also:Harry Enten Wife A Comprehensive Look Into His Personal Life

Tax Obligations for Non-Residents

Business Income Tax in New York

Useful Resources and References

Introduction to New York State Income Tax

New York State income tax is a critical component of the state's revenue system, impacting millions of residents annually. The tax is calculated based on an individual's or business's income and is subject to a progressive rate structure. Understanding how this system works is essential for compliance and financial planning.

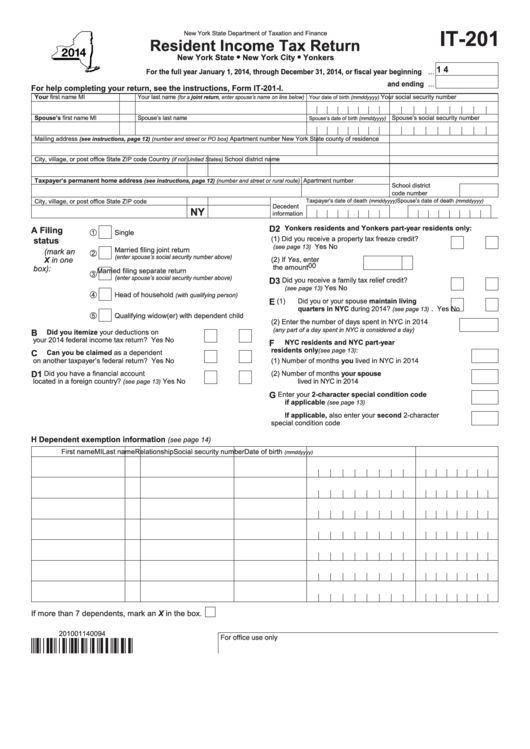

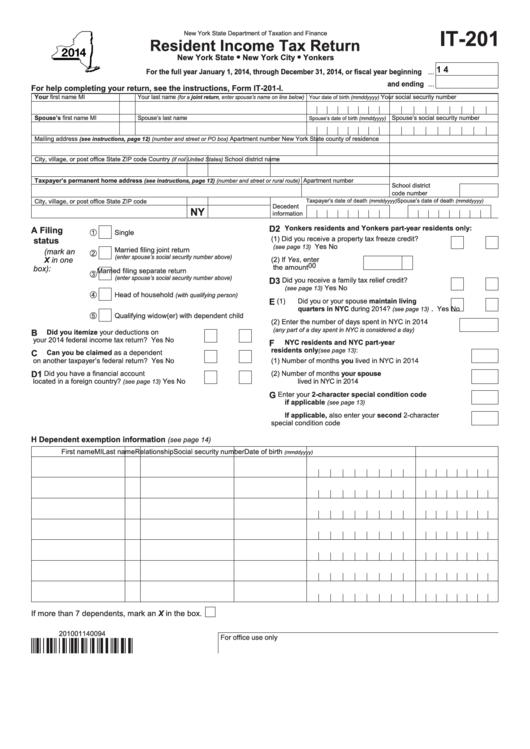

In addition to federal income tax obligations, New York residents must adhere to state-specific requirements. This includes filing Form IT-201 for individuals and various forms for businesses. The state offers numerous credits, deductions, and exemptions to help taxpayers reduce their overall liability.

New York State income tax is administered by the New York State Department of Taxation and Finance, which provides resources and support for taxpayers throughout the process. Staying informed about updates and changes to the tax code is essential for maintaining compliance.

New York State Income Tax Rates

New York State employs a progressive tax rate structure, meaning higher income levels are taxed at higher rates. For the 2023 tax year, the rates range from 4% for the lowest income bracket to 10.9% for the highest. Below is a breakdown of the current tax brackets:

- 4% for income up to $8,800

- 4.5% for income between $8,801 and $21,800

- 5.25% for income between $21,801 and $83,400

- 5.97% for income between $83,401 and $218,400

- 6.33% for income between $218,401 and $1,077,550

- 10.3% for income between $1,077,551 and $5,000,000

- 10.9% for income over $5,000,001

These rates are subject to change annually, so it's important to consult official resources for the most up-to-date information.

How to Calculate Your Tax Liability

To calculate your New York State income tax liability, you'll need to determine your taxable income and apply the appropriate tax rate. The state provides a tax calculator and worksheets to assist with this process. Additionally, deductions and credits can significantly impact your final tax bill.

Filing Status and Requirements

When filing your New York State income tax return, you must select the appropriate filing status based on your personal and financial situation. The available options include:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

Your filing status will affect your tax rate and eligibility for certain deductions and credits. It's important to choose the status that best reflects your circumstances to optimize your tax savings.

Who Must File a New York State Income Tax Return?

Residents of New York State are required to file a state income tax return if their federal adjusted gross income (AGI) exceeds specific thresholds. Non-residents who earn income within the state may also need to file, depending on their earnings and circumstances. For precise guidance, refer to the New York State Department of Taxation and Finance guidelines.

Exemptions and Deductions

New York State offers several exemptions and deductions to help taxpayers reduce their taxable income. These include:

- Standard deduction: A fixed amount that reduces taxable income for individuals and married couples filing jointly.

- Itemized deductions: Allow taxpayers to deduct specific expenses, such as mortgage interest, charitable contributions, and medical expenses.

- Personal exemptions: A deduction for each taxpayer and qualifying dependent.

Choosing between the standard deduction and itemized deductions depends on your individual financial situation. Consulting a tax professional can help you make the best decision.

Important Deductions for New Yorkers

Some key deductions available to New York State residents include:

- Retirement account contributions

- Student loan interest

- Healthcare expenses exceeding 7.5% of AGI

These deductions can significantly lower your taxable income, resulting in reduced tax liability.

Tax Credits Available

In addition to deductions, New York State offers various tax credits to assist taxpayers. Some notable credits include:

- Child Tax Credit: Provides a credit for each qualifying child under age 17.

- Low-Income Home Energy Assistance Program (LIHEAP): Helps low-income families with heating costs.

- Property Tax Credit: Reduces property tax burdens for eligible homeowners.

Tax credits directly reduce the amount of tax owed, making them valuable tools for reducing your overall liability.

How to Claim Tax Credits

To claim tax credits, you must meet specific eligibility requirements and complete the necessary forms. The New York State Department of Taxation and Finance provides detailed instructions and resources to help taxpayers navigate this process.

Important Filing Deadlines

Knowing the deadlines for filing your New York State income tax return is crucial to avoid penalties and interest. The standard deadline for individual taxpayers is April 15th, aligning with the federal tax deadline. However, if you need additional time, you can request an extension by filing Form IT-202.

Businesses and self-employed individuals may have different deadlines depending on their tax structure and reporting requirements. It's essential to stay organized and plan ahead to meet all deadlines.

Consequences of Missing Deadlines

Failing to file or pay your New York State income tax on time can result in penalties and interest charges. The state imposes a late filing penalty of 5% of the unpaid tax per month, up to a maximum of 25%. Additionally, interest accrues on unpaid balances at a rate determined by the state.

Tax Obligations for Non-Residents

Non-residents who earn income in New York State are subject to state income tax on that income. Common sources of income for non-residents include wages, salaries, tips, and business earnings. The tax is calculated based on the portion of income earned within the state.

Non-residents must file Form IT-203 to report their New York State income. This form allows taxpayers to calculate their tax liability and claim any applicable credits or deductions.

Key Considerations for Non-Residents

Non-residents should be aware of the following:

- Income sourced from New York State is subject to taxation, regardless of residency status.

- Credits and deductions may differ for non-residents compared to residents.

- Consulting a tax professional can help ensure compliance and maximize savings.

Business Income Tax in New York

Businesses operating in New York State are subject to various tax obligations, including corporate income tax and franchise tax. The rates and requirements depend on the business structure, such as corporations, partnerships, or sole proprietorships.

Corporations are taxed at a flat rate of 6.5% on their net income, while partnerships and sole proprietorships report their income on individual tax returns. Additionally, businesses may be eligible for credits and deductions to offset their tax liability.

Key Business Tax Considerations

Business owners should consider the following:

- Registering with the New York State Department of Taxation and Finance.

- Tracking deductible expenses and maintaining accurate records.

- Staying informed about changes to the tax code and regulations.

Common Mistakes to Avoid

Avoiding common tax mistakes can save you time, money, and frustration. Some frequent errors include:

- Not claiming all available deductions and credits.

- Miscalculating taxable income or tax liability.

- Missing deadlines or failing to file required forms.

To prevent these mistakes, double-check your calculations, consult official resources, and consider working with a tax professional if needed.

Tips for a Smooth Filing Process

Here are some tips to streamline your tax filing process:

- Organize your financial records and documentation.

- Use tax software or hire a professional for assistance.

- Review your return carefully before submitting.

Useful Resources and References

For more information on New York State income tax, consider the following resources:

- New York State Department of Taxation and Finance: https://www.tax.ny.gov/

- Internal Revenue Service (IRS): https://www.irs.gov/

- Publication 33: New York State Personal Income Tax Guide

These resources provide detailed guidance and updates on tax laws, forms, and procedures.

Conclusion and Final Thoughts

Understanding New York State income tax is essential for residents, business owners, and anyone earning income in the state. By staying informed about rates, filing requirements, deductions, and credits, you can optimize your tax strategy and avoid costly mistakes. Remember to consult official resources and seek professional advice when needed.

We encourage you to share this article with others who may benefit from the information. If you have questions or feedback, please leave a comment below. For more insights on personal finance and taxation, explore our other articles on the site.