New York State taxation is a crucial aspect of financial planning for both individuals and businesses. Understanding the tax structure in New York can help taxpayers avoid penalties and make informed decisions. This article will provide a detailed overview of the state's tax system, covering income tax, sales tax, property tax, and other relevant taxes.

Taxes play a vital role in funding public services, infrastructure, and education in New York. By staying informed about state taxation, residents and businesses can better manage their finances and ensure compliance with tax laws.

This guide aims to answer common questions about New York State taxation while providing practical advice to help taxpayers navigate the complexities of the system. Whether you're an individual filer or a business owner, this article will offer valuable insights into managing your tax obligations effectively.

Read also:Biltmore Scottsdale Restaurants A Culinary Paradise In The Heart Of Arizona

Table of Contents

- Introduction to New York State Taxation

- New York State Income Tax

- Sales Tax in New York

- Understanding Property Tax

- Business Taxes in New York

- Estate and Inheritance Tax

- Tax Exemptions and Credits

- Filing Your New York State Taxes

- Penalties for Late Payment

- Useful Resources and References

- Conclusion

Introduction to New York State Taxation

New York State taxation encompasses a wide range of levies designed to fund public services and infrastructure. The state imposes various taxes, including income tax, sales tax, property tax, and business taxes. Each of these taxes has specific rules and rates that taxpayers must adhere to.

The New York State Department of Taxation and Finance oversees the administration and collection of these taxes. By understanding the nuances of the tax system, taxpayers can minimize their liabilities and ensure compliance with state regulations.

New York State Income Tax

Overview of Income Tax Rates

New York State income tax is a progressive tax system with varying rates depending on the taxpayer's income level. As of the latest update, the state imposes a tax rate ranging from 4% to 10.9% for high-income earners. These rates apply to both residents and non-residents earning income within the state.

- Lower-income individuals pay a lower tax rate.

- Higher-income earners are subject to higher tax brackets.

Filing Status and Deductions

Taxpayers in New York can choose from several filing statuses, including single, married filing jointly, and head of household. Each status affects the standard deduction and tax credits available to the taxpayer.

For example, married couples filing jointly may qualify for higher deductions compared to single filers. Additionally, New York offers itemized deductions for certain expenses, such as medical costs and charitable contributions.

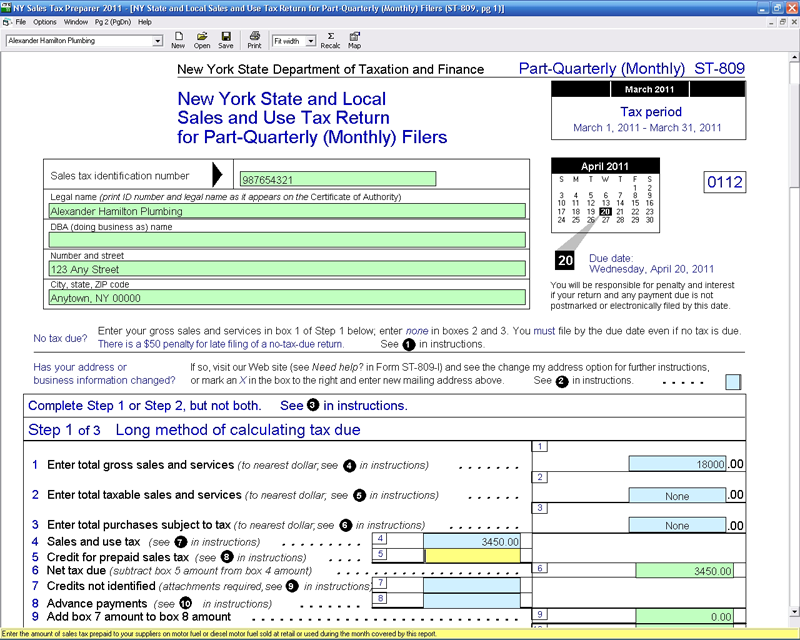

Sales Tax in New York

Statewide Sales Tax Rate

The statewide sales tax rate in New York is 4%. However, local jurisdictions may impose additional sales taxes, bringing the total rate to as high as 8.875% in some areas. This tax applies to most goods and services purchased within the state.

Read also:Micah Richards Wife A Comprehensive Look Into Her Life And Relationship

Exemptions and Special Rules

Certain items are exempt from sales tax, including groceries, prescription medications, and clothing priced under $110. Additionally, some counties offer sales tax holidays during specific periods, allowing consumers to purchase eligible items tax-free.

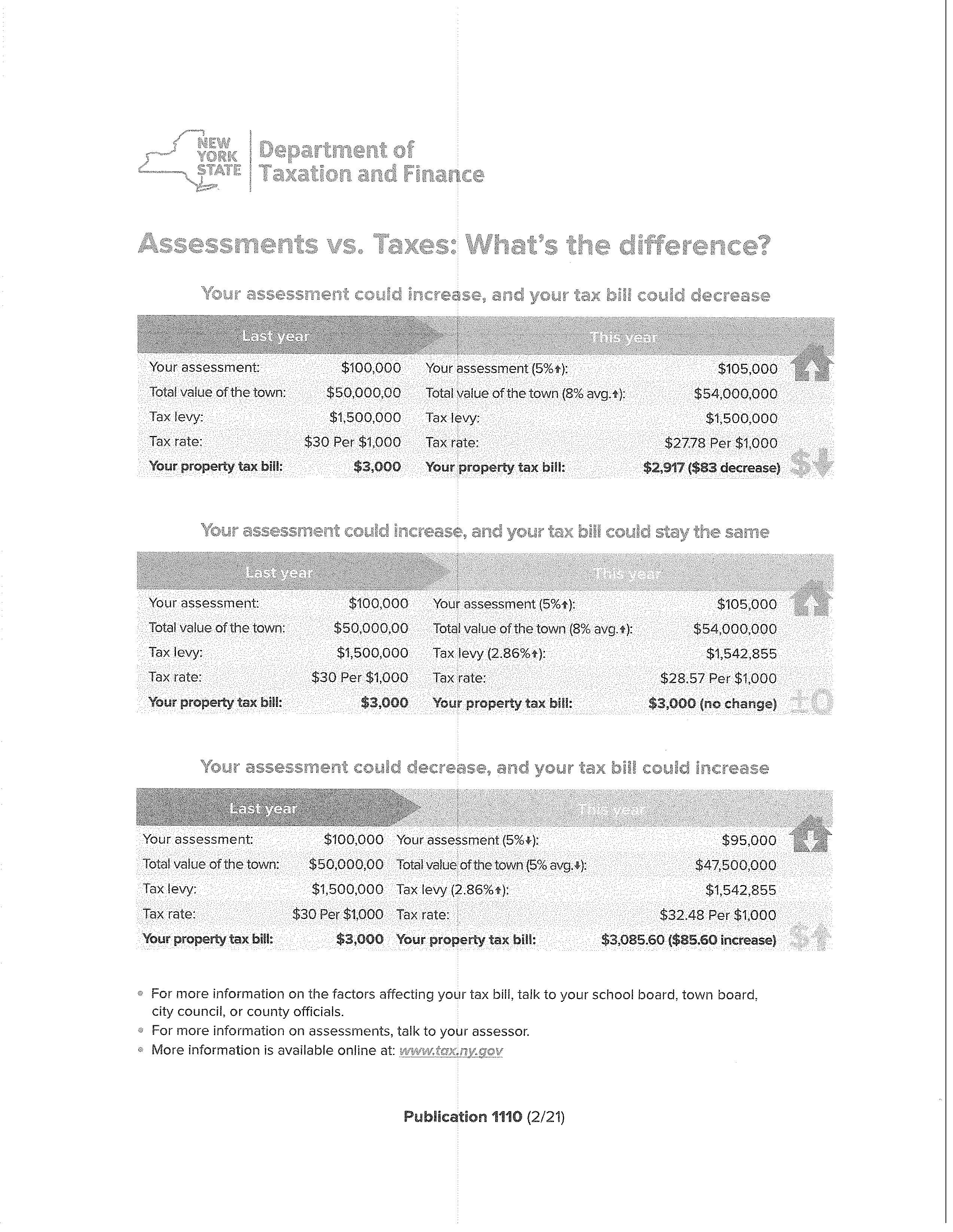

Understanding Property Tax

How Property Tax is Calculated

Property tax in New York is based on the assessed value of the property. The assessment is typically a percentage of the market value, and the tax rate varies by municipality. Homeowners receive an assessment notice annually, detailing the property's value and corresponding tax liability.

Relief Programs for Homeowners

New York offers several property tax relief programs, such as the Basic STAR and Enhanced STAR programs, which provide exemptions for primary residences. Eligible senior citizens and disabled individuals may also qualify for additional reductions.

Business Taxes in New York

Corporate Income Tax

Businesses operating in New York are subject to corporate income tax, with rates ranging from 6.5% to 8.84%. The tax is calculated based on the company's net income attributable to the state. Certain industries, such as manufacturers, may qualify for tax incentives and credits.

Franchise Tax

In addition to corporate income tax, New York imposes a franchise tax on corporations. This tax is based on the company's capital stock or net worth, whichever is greater. Small businesses may qualify for reduced rates or exemptions.

Estate and Inheritance Tax

Estate Tax Threshold

New York imposes an estate tax on estates exceeding a certain threshold, which is adjusted annually for inflation. As of the latest update, the exemption amount is approximately $6.3 million. Estates below this threshold are exempt from taxation.

Inheritance Tax Considerations

Unlike some states, New York does not have a separate inheritance tax. However, beneficiaries may be subject to federal estate tax if the estate exceeds the federal exemption limit.

Tax Exemptions and Credits

Common Tax Credits

New York offers various tax credits to help reduce the tax burden on individuals and businesses. Some of the most popular credits include the Child Tax Credit, Earned Income Tax Credit (EITC), and credits for higher education expenses.

Exemptions for Specific Groups

Certain groups, such as veterans, senior citizens, and low-income families, may qualify for additional tax exemptions. These exemptions aim to provide financial relief to those who need it most.

Filing Your New York State Taxes

Deadlines and Extensions

The deadline for filing New York State taxes is typically April 15th, aligning with the federal tax deadline. Taxpayers who need more time can request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Online Filing Options

New York encourages electronic filing through its official website, TurboTax, or other certified tax software. E-filing offers several advantages, including faster processing times and reduced errors.

Penalties for Late Payment

Consequences of Non-Compliance

Failing to file or pay taxes on time can result in significant penalties and interest charges. The New York State Department of Taxation and Finance imposes penalties ranging from 5% to 25% of the unpaid tax, depending on the severity of the delay.

Options for Resolving Outstanding Taxes

Taxpayers facing financial difficulties can explore payment plans or settlement options to resolve outstanding tax liabilities. The state offers installment agreements and offers in compromise to help taxpayers get back on track.

Useful Resources and References

For more information on New York State taxation, consider consulting the following resources:

- New York State Department of Taxation and Finance

- IRS Publication 553: Tax Withholding and Estimated Tax

- Local tax preparation services and certified public accountants (CPAs)

These resources provide detailed guidance on state and federal tax laws, helping taxpayers stay informed and compliant.

Conclusion

In conclusion, understanding New York State taxation is essential for managing personal and business finances effectively. By familiarizing yourself with income tax, sales tax, property tax, and other levies, you can minimize your tax liabilities and avoid penalties.

We encourage you to share this article with others who may benefit from the information. For further assistance, consult a tax professional or visit the official New York State Department of Taxation and Finance website. Your feedback and questions are always welcome in the comments section below.