Understanding tax in NY is crucial for both residents and businesses operating within the state. Whether you're filing personal income taxes, running a small business, or simply trying to make sense of sales tax rates, navigating New York's tax system can be complex. This guide aims to break down the intricacies of New York taxes, providing you with actionable insights to help you manage your finances effectively.

New York State is known for its high tax rates compared to other states in the U.S. However, understanding how these taxes work can help you plan better and avoid unnecessary financial burdens. From income taxes to property taxes, this guide will walk you through each aspect of taxation in New York.

This article is designed to provide clarity and actionable advice to help you navigate the tax landscape in New York. By the end, you'll have a solid understanding of how taxes affect individuals and businesses in the state, empowering you to make informed decisions.

Read also:Tulsi Gabbard Kids Exploring The Family Life And Personal Journey Of Congresswoman Tulsi Gabbard

Table of Contents

- Introduction to Tax in NY

- Income Tax in New York

- Sales Tax in New York

- Property Tax in New York

- Business Tax in New York

- Tax Exemptions and Deductions

- Filing Your Taxes in New York

- Penalties for Late Filing

- Tax Planning Tips

- Common Tax Questions

- Conclusion

Introduction to Tax in NY

Why Understanding Tax in NY is Important

Taxes are a fundamental aspect of living and working in New York. Whether you're a resident, business owner, or visitor, understanding the tax structure in New York can help you avoid financial pitfalls. New York's tax system is unique, with various levels of taxation, including state, city, and local taxes.

For individuals, knowing how much of your income goes to taxes can help you budget effectively. For businesses, understanding tax obligations ensures compliance and helps optimize financial strategies. This section provides an overview of the tax landscape in New York, setting the stage for a deeper dive into specific tax types.

Income Tax in New York

Overview of New York State Income Tax

New York State income tax is progressive, meaning that higher income levels are taxed at higher rates. As of 2023, the state income tax rates range from 4% to 10.9% depending on your taxable income. For residents of New York City, there's an additional city income tax, which further increases the overall tax burden.

- New York State Income Tax Rates:

- 4% for income up to $8,500

- 4.5% for income between $8,501 and $11,700

- 5.25% for income between $11,701 and $139,350

- Higher rates apply for incomes above $139,350

It's important to note that these rates are subject to change, so always refer to the latest tax guidelines provided by the New York State Department of Taxation and Finance.

Sales Tax in New York

Understanding Sales Tax Rates in New York

Sales tax in New York is another significant aspect of the state's tax system. The state sales tax rate is 4%, but local jurisdictions can add their own rates, resulting in total sales tax rates that vary across the state. In New York City, for example, the combined sales tax rate is 8.875%.

Certain items are exempt from sales tax, such as groceries and prescription medications. However, non-prescription medications and prepared foods are generally subject to sales tax. Understanding these exemptions can help you save money when shopping.

Read also:Does Red Bull Support Trump

Property Tax in New York

How Property Tax Works in New York

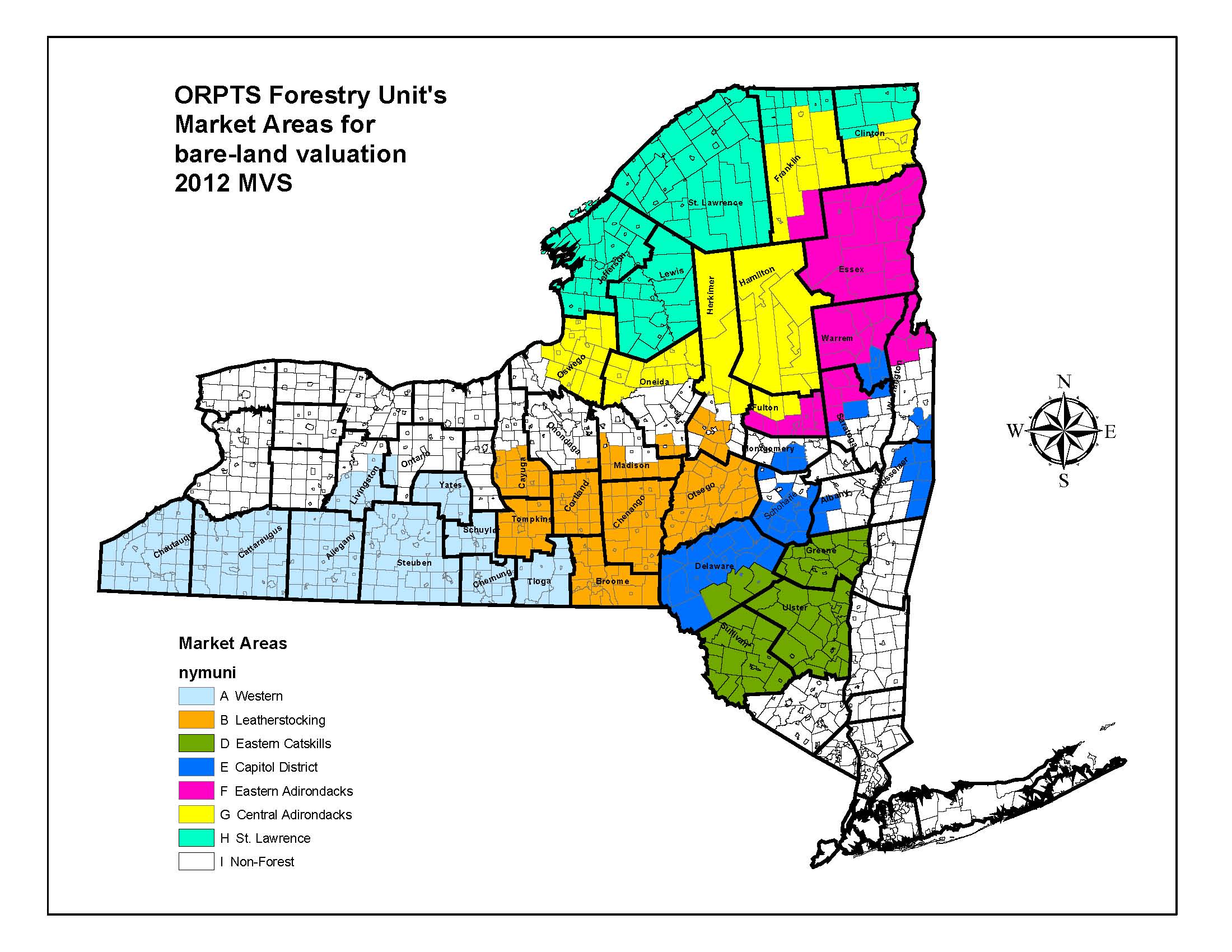

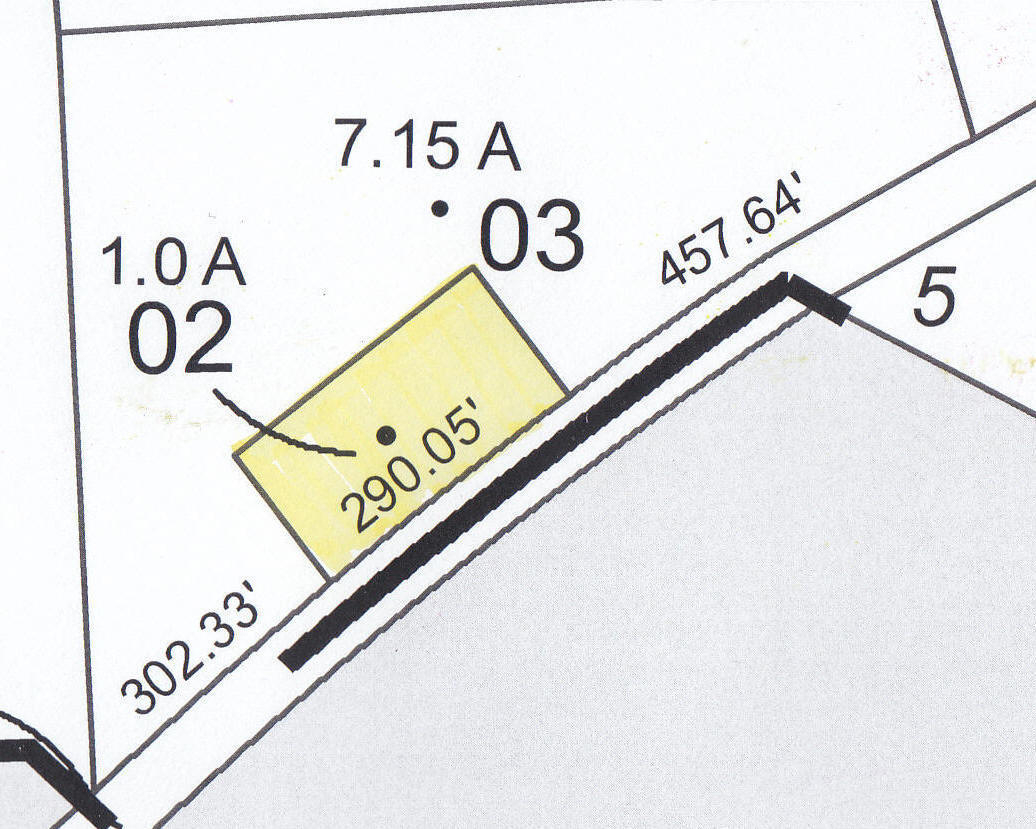

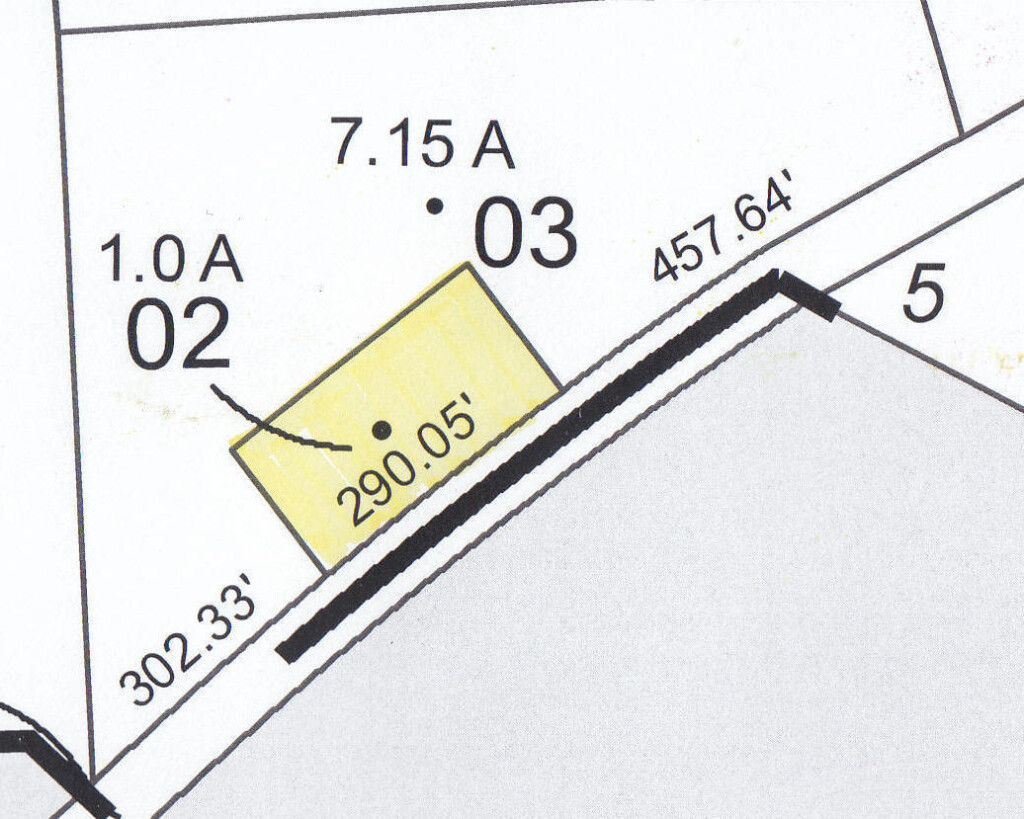

Property tax in New York is assessed at the local level, with rates varying significantly depending on the location. Property tax is typically calculated based on the assessed value of the property, which is determined by local assessors.

Homeowners can apply for various exemptions and abatements to reduce their property tax burden. Some common exemptions include the Basic STAR program for homeowners and the Enhanced STAR program for senior citizens. These programs can provide significant savings, so it's worth exploring if you qualify.

Business Tax in New York

Tax Obligations for Businesses in New York

Businesses operating in New York are subject to various taxes, including corporate income tax, franchise tax, and sales tax. The corporate income tax rate for businesses is 6.5%, with additional surcharges for businesses with higher incomes.

Small businesses may qualify for tax credits and incentives designed to encourage growth and job creation. These programs can help reduce the overall tax burden and provide financial relief to businesses struggling with high tax rates.

Tax Exemptions and Deductions

Exploring Tax Benefits in New York

New York offers a variety of tax exemptions and deductions to help residents and businesses reduce their tax liabilities. Some of the most common deductions include the mortgage interest deduction, property tax deduction, and charitable contribution deduction.

Exemptions such as the Basic STAR program for homeowners and the Enhanced STAR program for seniors can provide significant relief from property taxes. Additionally, certain income levels may qualify for earned income tax credits, which can reduce or eliminate state income tax obligations.

Filing Your Taxes in New York

Steps to File Your Taxes in New York

Filing taxes in New York can be done through the New York State Department of Taxation and Finance website. Individuals and businesses can file their taxes online, making the process more convenient and efficient.

It's important to gather all necessary documentation before filing, including W-2 forms, 1099 forms, and any other relevant financial records. Filing electronically can help ensure accuracy and expedite the refund process if applicable.

Penalties for Late Filing

Avoiding Late Filing Penalties in New York

Failing to file your taxes on time can result in significant penalties and interest charges. The New York State Department of Taxation and Finance imposes penalties for late filing, which can accumulate over time if not addressed promptly.

It's crucial to file your taxes by the deadline, even if you're unable to pay the full amount owed. If you anticipate difficulty paying your taxes, consider applying for an installment agreement or seeking professional tax advice to explore your options.

Tax Planning Tips

Strategies for Effective Tax Planning in New York

Effective tax planning can help you minimize your tax liabilities and maximize your financial resources. Some strategies to consider include:

- Maximizing contributions to retirement accounts such as 401(k)s and IRAs.

- Taking advantage of available tax credits and deductions.

- Consulting with a tax professional to ensure compliance and optimize your tax strategy.

Staying informed about changes in tax laws and regulations is also essential for effective tax planning. Regularly reviewing your financial situation and adjusting your tax strategy accordingly can help you achieve long-term financial goals.

Common Tax Questions

Answers to Frequently Asked Tax Questions

Here are some common questions about taxes in New York:

- What is the deadline for filing taxes in New York?

- How do I apply for tax exemptions or deductions?

- What happens if I miss the tax filing deadline?

For detailed answers to these and other tax-related questions, refer to the New York State Department of Taxation and Finance website or consult with a tax professional.

Conclusion

In conclusion, understanding tax in NY is essential for anyone living or doing business in the state. By familiarizing yourself with the various types of taxes, available exemptions, and filing requirements, you can better manage your financial obligations and take advantage of opportunities to reduce your tax burden.

We encourage you to take action by reviewing your tax situation, exploring available deductions, and seeking professional advice if needed. Don't forget to share this article with others who may find it helpful and explore our other resources for more information on financial planning and tax management.