The Department of Retirement Systems Washington plays a crucial role in managing retirement benefits for public employees across the state. Established to ensure financial security for its members, this department oversees various retirement plans, including those for teachers, law enforcement officers, and other state workers. Understanding its functions and offerings is essential for anyone planning their retirement in Washington.

Retirement planning can be daunting, especially when navigating the complexities of state-specific systems. The Department of Retirement Systems Washington simplifies this process by providing resources and support for its members. By understanding how the department operates and the benefits it offers, individuals can make informed decisions about their financial futures.

Whether you're a public employee preparing for retirement or someone seeking to learn more about Washington's retirement systems, this article will serve as a detailed guide. We'll explore the history, functions, and benefits offered by the department, as well as tips for maximizing your retirement savings. Let's dive in.

Read also:Trisha Meili Apology A Comprehensive Look At The Central Park Jogger Case

Table of Contents

- Introduction to the Department of Retirement Systems Washington

- History and Establishment

- Key Functions and Responsibilities

- Types of Retirement Plans Offered

- Eligibility Requirements

- Understanding Your Retirement Benefits

- Contribution Rates and Options

- Disability and Survivor Benefits

- Resources for Members

- The Future of Retirement Systems in Washington

Introduction to the Department of Retirement Systems Washington

The Department of Retirement Systems Washington is a vital entity responsible for administering retirement benefits for public employees in the state. Established to ensure that workers have a secure financial future, the department manages a variety of retirement plans tailored to different professions. From teachers and police officers to state workers and firefighters, the department caters to a diverse group of employees.

The primary goal of the department is to provide stability and peace of mind to its members by offering comprehensive retirement solutions. By understanding the intricacies of these plans, individuals can better prepare for their post-work life. This section will provide an overview of the department's mission, vision, and the importance of its role in Washington's public workforce.

History and Establishment

The Department of Retirement Systems Washington was established in 1947 to address the growing need for structured retirement plans for public employees. Over the decades, the department has evolved to meet the changing demands of the workforce. Initially, it focused on providing basic retirement benefits, but today, it offers a wide range of services and plans to accommodate the diverse needs of its members.

Key milestones in the department's history include the introduction of new retirement plans, the expansion of eligibility criteria, and the implementation of modern technology to streamline processes. Understanding the history of the department provides valuable insight into its current operations and future direction.

Evolution of Retirement Plans

Over the years, the Department of Retirement Systems Washington has introduced several new plans to better serve its members. Some of these include:

- Public Employees' Retirement System (PERS)

- Teachers' Retirement System (TRS)

- Law Enforcement Officers' and Fire Fighters' Retirement System (LEOFF)

Each plan is designed to meet the unique needs of its members, ensuring that all public employees have access to a secure retirement.

Read also:Melissa Oneil Weight A Comprehensive Guide

Key Functions and Responsibilities

The Department of Retirement Systems Washington performs several critical functions to ensure the smooth operation of its retirement plans. These include administering benefits, managing contributions, and providing resources for members. Below are some of the department's key responsibilities:

- Administering retirement plans and benefits

- Managing contributions from employers and employees

- Providing educational resources and workshops

- Offering customer support and assistance

By fulfilling these responsibilities, the department ensures that its members receive the benefits they deserve and are well-informed about their retirement options.

Types of Retirement Plans Offered

The Department of Retirement Systems Washington offers a variety of retirement plans to cater to different professions and employment statuses. These plans include:

Public Employees' Retirement System (PERS)

PERS is designed for state employees and provides a defined benefit plan, ensuring a stable income during retirement. Members contribute a portion of their salary, and the state matches these contributions to fund the plan.

Teachers' Retirement System (TRS)

TRS is specifically tailored for educators and school district employees. It offers similar benefits to PERS, with contributions from both the member and the employer.

Law Enforcement Officers' and Fire Fighters' Retirement System (LEOFF)

LEOFF provides retirement benefits for law enforcement officers and firefighters, acknowledging the unique challenges and risks associated with these professions.

Each plan has its own set of rules and benefits, making it important for members to understand which plan applies to them.

Eligibility Requirements

To participate in the retirement plans offered by the Department of Retirement Systems Washington, individuals must meet specific eligibility criteria. These requirements vary depending on the plan and may include factors such as:

- Length of service

- Age

- Employment status

For example, members of PERS must have a minimum number of service years to qualify for full benefits. Similarly, LEOFF participants must meet certain age and service requirements. Understanding these criteria is essential for planning a successful retirement.

Understanding Your Retirement Benefits

The benefits provided by the Department of Retirement Systems Washington include monthly payments, survivor benefits, and disability support. These benefits are designed to ensure financial stability during retirement and in the event of unforeseen circumstances.

Monthly Payments

Members receive monthly payments based on their years of service, final average salary, and the type of plan they are enrolled in. These payments are adjusted annually to account for inflation, ensuring that members maintain their purchasing power.

Survivor Benefits

In the event of a member's death, their beneficiaries may be eligible for survivor benefits. These benefits provide financial support to surviving spouses and dependents, helping them maintain their standard of living.

By understanding the benefits available, members can better plan for their retirement and ensure the financial security of their loved ones.

Contribution Rates and Options

Members of the Department of Retirement Systems Washington contribute a portion of their salary to their retirement plan. The contribution rate varies depending on the plan and the member's employment status. For example:

- PERS members contribute between 6% and 9% of their salary

- TRS members contribute between 7% and 10% of their salary

- LEOFF members contribute between 8% and 12% of their salary

In addition to mandatory contributions, members may have the option to make voluntary contributions to enhance their retirement savings. These additional contributions can provide greater financial security during retirement.

Disability and Survivor Benefits

The Department of Retirement Systems Washington also offers disability and survivor benefits to its members. These benefits provide financial support in the event of a member's disability or death.

Disability Benefits

Members who become disabled and are unable to work may be eligible for disability benefits. These benefits provide a monthly income to help cover living expenses and medical costs. The eligibility criteria for disability benefits vary depending on the plan and the nature of the disability.

Survivor Benefits

As mentioned earlier, survivor benefits are available to the beneficiaries of deceased members. These benefits ensure that surviving spouses and dependents receive financial support, helping them maintain their standard of living.

Understanding these benefits is crucial for members and their families, as they provide essential financial protection during challenging times.

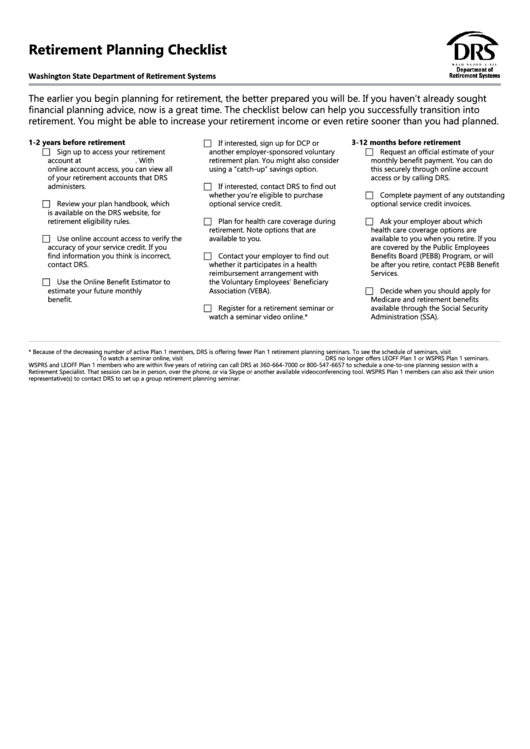

Resources for Members

The Department of Retirement Systems Washington offers a wealth of resources to help members navigate their retirement plans. These resources include:

- Online tools for tracking contributions and benefits

- Workshops and seminars on retirement planning

- Customer support and assistance

By utilizing these resources, members can make informed decisions about their retirement and ensure that they are on track to meet their financial goals.

The Future of Retirement Systems in Washington

As the workforce continues to evolve, so too must retirement systems. The Department of Retirement Systems Washington is committed to adapting to these changes and ensuring that its members receive the best possible benefits. Future developments may include:

- Introducing new plans to accommodate emerging professions

- Enhancing online tools and resources for members

- Increasing contribution limits to allow for greater savings

By staying ahead of these changes, the department can continue to provide valuable services to its members and ensure their financial security in the years to come.

Conclusion

In conclusion, the Department of Retirement Systems Washington plays a vital role in ensuring the financial security of public employees in the state. By understanding the department's history, functions, and offerings, members can make informed decisions about their retirement and plan for a secure financial future.

We encourage you to explore the resources provided by the department and take advantage of the benefits available to you. Whether you're just starting your career or nearing retirement, the Department of Retirement Systems Washington is here to support you every step of the way. Share this article with your colleagues and friends, and don't hesitate to leave a comment or question below. Together, we can ensure a brighter financial future for all.