The State of California Franchise Tax Board (FTB) plays a crucial role in the state's fiscal management, overseeing tax compliance and ensuring that businesses and individuals fulfill their tax obligations. Established to regulate taxes and franchise fees, the FTB is a vital entity for anyone operating or residing in California. Whether you're a small business owner or an individual taxpayer, understanding the FTB's functions and responsibilities is essential to avoid penalties and ensure compliance.

California's tax landscape can be complex, especially for those unfamiliar with its intricacies. The FTB is responsible for enforcing tax laws, processing tax returns, and collecting revenue to fund public services. This article will provide a detailed overview of the FTB, its role, and how it impacts businesses and individuals. By the end of this guide, you'll have a clearer understanding of how to navigate California's tax system effectively.

Whether you're dealing with business taxes, personal income taxes, or other financial obligations, the FTB is a key player in ensuring the state's financial health. In this article, we'll explore the ins and outs of the California Franchise Tax Board, offering actionable insights and expert advice to help you stay compliant and informed.

Read also:Why Is Greg Gutfeld In The Hospital Exploring The Facts And Insights

What is the California Franchise Tax Board?

The California Franchise Tax Board is a state agency tasked with administering state tax laws and collecting revenue. Established in 1945, the FTB ensures that businesses and individuals pay their fair share of taxes, which are used to fund essential services such as education, healthcare, and infrastructure. The FTB's primary focus is on personal income taxes, corporate taxes, and franchise fees, making it a critical component of California's financial framework.

As part of its mandate, the FTB provides resources and support to taxpayers, including forms, guides, and online tools to simplify the tax filing process. It also enforces compliance through audits, penalties, and legal actions when necessary. Understanding the FTB's role is essential for anyone doing business or living in California, as it directly impacts your financial obligations.

Key Responsibilities of the Franchise Tax Board

Administering State Taxes

The FTB is responsible for administering a wide range of state taxes, including:

- Personal Income Tax: Collected from individuals based on their earnings.

- Corporation Tax: Levied on businesses operating within California.

- Franchise Tax: A flat fee charged to corporations and LLCs for the privilege of doing business in the state.

- Withholding Tax: Employers are required to withhold taxes from employee wages and remit them to the FTB.

These taxes contribute significantly to the state's revenue, which is used to fund public services and infrastructure projects.

Enforcing Tax Compliance

One of the FTB's primary responsibilities is enforcing tax compliance. This includes:

- Conducting audits to ensure accurate reporting and payment of taxes.

- Imposing penalties and interest for late payments or underreported taxes.

- Pursuing legal action against individuals or businesses that fail to comply with tax laws.

Compliance is crucial for maintaining the integrity of California's tax system and ensuring that all taxpayers contribute fairly.

Read also:Sophie Lauren 2025 A Comprehensive Look Into The Future Of A Rising Star

How the Franchise Tax Board Impacts Businesses

Corporate Taxes and Franchise Fees

Businesses operating in California are subject to corporate taxes and franchise fees, both of which are administered by the FTB. Corporate taxes are calculated based on a company's net income, while franchise fees are a flat rate charged to corporations and LLCs for the privilege of doing business in the state.

For example:

- Corporations with net income exceeding $1 million pay an 8.84% tax rate.

- All corporations and LLCs must pay a minimum franchise tax of $800 annually.

Understanding these obligations is essential for businesses to avoid penalties and ensure compliance.

Tax Filing Requirements for Businesses

Businesses must file annual tax returns with the FTB, providing detailed information about their income, expenses, and tax liabilities. The FTB offers various resources to simplify the filing process, including online tools and detailed guides. Meeting these requirements on time is crucial to avoid late filing penalties and interest charges.

Personal Income Tax and the Franchise Tax Board

Understanding Personal Income Tax

Individuals residing in California are subject to personal income tax, which is calculated based on their earnings. The FTB uses a progressive tax system, meaning that higher income levels are taxed at higher rates. For example:

- Single filers earning up to $10,099 pay a tax rate of 1%.

- Single filers earning over $596,025 pay a tax rate of 13.3%.

Understanding your tax bracket and obligations is essential for accurate reporting and payment.

Filing Personal Income Tax Returns

Individuals must file annual tax returns with the FTB by April 15th, or request an extension if needed. The FTB provides various resources to assist with the filing process, including online tools and detailed guides. Ensuring timely and accurate filing is crucial to avoid penalties and interest charges.

FTB Resources and Support

Online Tools and Services

The FTB offers a range of online tools and services to assist taxpayers, including:

- Electronic Filing (e-Filing): Allows taxpayers to file their returns electronically, reducing processing times.

- FTB Online: Provides access to account information, payment history, and tax forms.

- Taxpayer Assistance: Offers live chat support and phone assistance to address taxpayer inquiries.

These resources simplify the tax filing process and provide valuable support to taxpayers.

Publications and Guides

The FTB publishes a variety of guides and publications to help taxpayers understand their obligations. These include:

- Tax Guides: Detailed explanations of tax laws and regulations.

- Forms and Instructions: Comprehensive guides for completing tax forms accurately.

- Frequently Asked Questions (FAQs): Answers to common taxpayer questions.

Utilizing these resources can help taxpayers navigate the complexities of California's tax system more effectively.

Common Issues with the Franchise Tax Board

Audits and Penalties

One of the most common issues taxpayers face with the FTB is audits and penalties. The FTB conducts audits to ensure accurate reporting and payment of taxes. If discrepancies are found, taxpayers may face penalties and interest charges. Common reasons for audits include:

- Underreported income.

- Inaccurate deductions or credits.

- Failure to file or pay taxes on time.

Addressing these issues promptly and working with the FTB can help resolve disputes and minimize penalties.

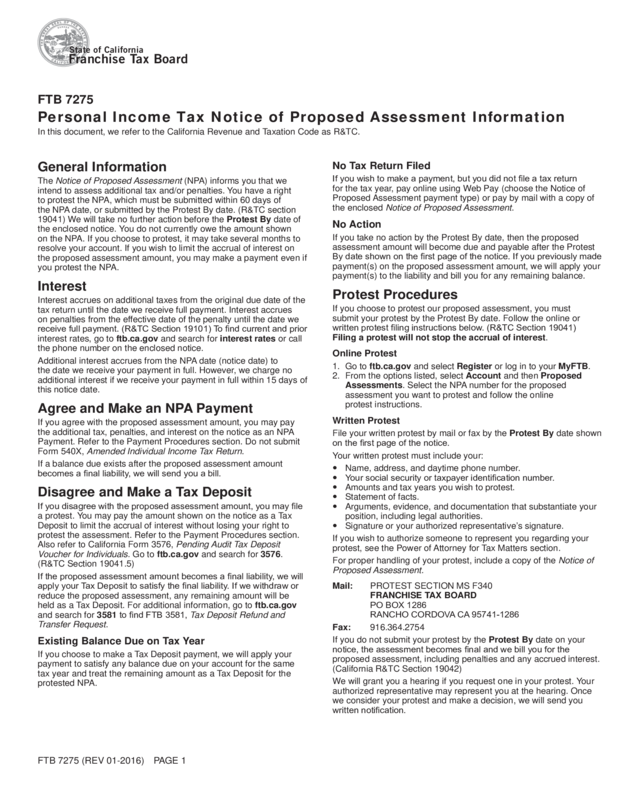

Resolving Disputes

Disputes with the FTB can arise over tax assessments, penalties, or other issues. Taxpayers have the right to appeal decisions and resolve disputes through formal processes. This includes:

- Filing protests or appeals to contest assessments or penalties.

- Requesting a hearing to present your case before an impartial officer.

- Seeking legal representation if necessary to protect your rights.

Understanding your rights and options is crucial when dealing with disputes involving the FTB.

How to Stay Compliant with the FTB

Best Practices for Tax Compliance

Staying compliant with the FTB requires proactive measures and attention to detail. Here are some best practices:

- Keep accurate records of income, expenses, and tax payments.

- File tax returns on time and pay all taxes due.

- Utilize FTB resources and tools to simplify the filing process.

- Stay informed about changes in tax laws and regulations.

Implementing these practices can help you avoid penalties and ensure smooth interactions with the FTB.

Seeking Professional Assistance

For complex tax situations, seeking professional assistance from accountants or tax advisors is advisable. These professionals can help you navigate the complexities of California's tax system and ensure compliance. They can also assist with audits, disputes, and other tax-related issues, providing valuable expertise and support.

Conclusion

The State of California Franchise Tax Board plays a vital role in administering tax laws and ensuring compliance. Whether you're a business owner or an individual taxpayer, understanding the FTB's functions and responsibilities is essential for navigating California's tax system effectively. By staying informed, utilizing available resources, and implementing best practices, you can ensure compliance and avoid penalties.

We encourage you to take action by reviewing your tax obligations, utilizing FTB resources, and seeking professional assistance if needed. Share this article with others who may benefit from the information, and explore other articles on our site for further insights into tax-related topics. Together, we can ensure a smoother and more informed approach to tax compliance in California.

Table of Contents

- What is the California Franchise Tax Board?

- Key Responsibilities of the Franchise Tax Board

- How the Franchise Tax Board Impacts Businesses

- Personal Income Tax and the Franchise Tax Board

- FTB Resources and Support

- Common Issues with the Franchise Tax Board

- How to Stay Compliant with the FTB