The California Franchise Tax Board (FTB) plays a crucial role in managing and overseeing tax-related matters within the state of California. Whether you're an individual taxpayer or a business owner, understanding the FTB's functions and responsibilities is essential for ensuring compliance with state tax laws. This article aims to provide a detailed overview of the FTB, its significance, and how it impacts taxpayers.

As one of the most populous states in the United States, California has a complex tax system designed to generate revenue for public services and infrastructure. The FTB acts as the primary agency responsible for administering these tax laws. Whether you're dealing with personal income tax, business taxes, or other financial obligations, the FTB ensures that all taxpayers fulfill their responsibilities accurately and on time.

This article will delve into the inner workings of the FTB, covering everything from its history and structure to its role in enforcing tax compliance. By the end of this guide, you'll have a clear understanding of what the FTB does, how it affects you, and the steps you can take to ensure compliance with California's tax regulations.

Read also:Madeleine Mccann The Mysterious Disappearance That Shook The World

Table of Contents

- Introduction to California FTB

- History of the FTB

- Key Functions of the FTB

- Types of Taxes Administered by the FTB

- Taxpayer Compliance and Enforcement

- Resources and Tools for Taxpayers

- FTB's Role in Business Taxes

- FTB's Role in Individual Taxes

- Common Issues with the FTB

- The Future of the FTB

Introduction to California FTB

The California Franchise Tax Board (FTB) is a state agency responsible for administering California's tax laws. Established to ensure fairness and transparency in tax collection, the FTB manages various tax-related activities, including processing tax returns, collecting unpaid taxes, and enforcing compliance with state regulations.

Why the FTB Matters

For both individuals and businesses, the FTB is a critical entity to understand. Its primary goal is to ensure that all taxpayers contribute their fair share to the state's revenue, which funds essential public services such as education, healthcare, and infrastructure. By staying informed about the FTB's responsibilities and requirements, taxpayers can avoid penalties and ensure timely compliance.

History of the FTB

The FTB was established in 1969 as part of a broader effort to streamline California's tax administration system. Prior to its creation, tax-related responsibilities were scattered across multiple agencies, leading to inefficiencies and confusion. The FTB's formation centralized these functions, making it easier for taxpayers to navigate the state's tax system.

Evolution Over the Years

- 1969: Establishment of the FTB as a standalone agency.

- 1980s: Expansion of digital tools for tax processing.

- 2000s: Introduction of online services for taxpayer convenience.

Key Functions of the FTB

The FTB performs a wide range of functions aimed at maintaining a fair and efficient tax system. These include:

- Processing individual and business tax returns.

- Collecting unpaid taxes and penalties.

- Providing guidance and resources to taxpayers.

- Enforcing compliance with state tax laws.

How the FTB Supports Taxpayers

Through its various programs and initiatives, the FTB aims to assist taxpayers in understanding their obligations. This includes offering educational materials, hosting workshops, and providing personalized support through its customer service team.

Types of Taxes Administered by the FTB

The FTB oversees several types of taxes, each with its own set of rules and requirements. These include:

Read also:Discover The World Of Rouz Bandi A Comprehensive Guide

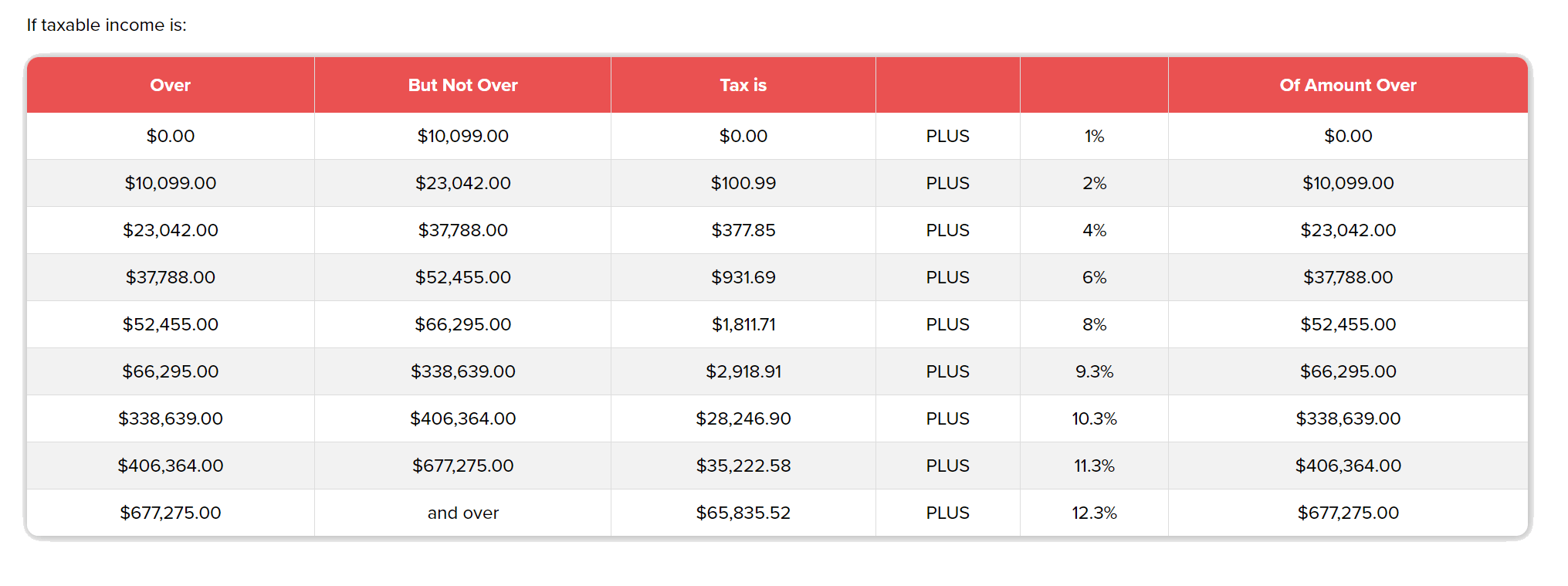

- Personal income tax: Applied to wages, investments, and other forms of income.

- Corporation tax: Levied on businesses operating within California.

- Franchise tax: A fixed fee imposed on corporations and LLCs.

Understanding Your Tax Obligations

Whether you're an individual or a business, it's important to understand which taxes apply to your situation. The FTB provides detailed guidelines to help taxpayers navigate these complexities.

Taxpayer Compliance and Enforcement

One of the FTB's primary responsibilities is ensuring taxpayer compliance. This involves monitoring tax filings, investigating discrepancies, and taking action against non-compliance.

Penalties for Non-Compliance

Taxpayers who fail to meet their obligations may face penalties, including:

- Fines for late filing or payment.

- Interest on unpaid taxes.

- Potential legal action in severe cases.

Resources and Tools for Taxpayers

The FTB offers a variety of resources to help taxpayers stay informed and compliant. These include:

- Online tax filing systems.

- Interactive tools for calculating tax liabilities.

- Guides and publications covering specific tax topics.

How to Access FTB Resources

Most of the FTB's resources are available online, making it easy for taxpayers to access the information they need. Simply visit the FTB's official website to explore these tools and learn more about your tax obligations.

FTB's Role in Business Taxes

For businesses operating in California, the FTB plays a vital role in ensuring compliance with state tax laws. This includes administering corporation taxes, franchise fees, and other business-related obligations.

Key Considerations for Businesses

Business owners should be aware of the following:

- Annual franchise tax requirements.

- Deadlines for filing business tax returns.

- Potential deductions and credits available to businesses.

FTB's Role in Individual Taxes

Individual taxpayers also rely on the FTB for guidance and support in managing their tax obligations. From filing personal income tax returns to addressing discrepancies, the FTB provides a range of services to assist individuals.

Common Questions About Personal Taxes

Some frequently asked questions about personal taxes include:

- What deductions am I eligible for?

- How do I file my tax return online?

- What happens if I miss the filing deadline?

Common Issues with the FTB

Despite its many resources, taxpayers may encounter issues when dealing with the FTB. These can include:

- Delays in processing tax returns.

- Confusion over tax obligations and deadlines.

- Challenges in resolving disputes with the agency.

Resolving FTB-Related Issues

Taxpayers experiencing difficulties can seek assistance through the FTB's customer service channels or consult with a tax professional for guidance.

The Future of the FTB

As technology continues to evolve, the FTB is adapting its systems and processes to better serve taxpayers. This includes expanding digital services, enhancing data security, and improving communication with the public.

Innovations in Tax Administration

Future developments may include:

- Increased use of artificial intelligence for tax processing.

- Enhanced cybersecurity measures to protect taxpayer information.

- More personalized support through chatbots and virtual assistants.

Conclusion

In conclusion, the California Franchise Tax Board (FTB) is a critical component of the state's tax system, ensuring that all taxpayers fulfill their obligations fairly and efficiently. By understanding the FTB's functions, responsibilities, and resources, individuals and businesses can navigate the complexities of California's tax laws with confidence.

We encourage you to take action by exploring the FTB's website, utilizing its resources, and staying informed about your tax obligations. If you found this article helpful, please share it with others and consider exploring our other content for more insights into tax-related topics.