As the Paycheck Protection Program (PPP) continues to evolve, businesses and individuals need to stay informed about the warrant list for PPP loans. This list plays a crucial role in ensuring transparency and accountability in the distribution of these loans. If you're unfamiliar with the warrant list or how it affects PPP loans, this guide will provide all the necessary details.

The warrant list for PPP loan is a document that outlines specific conditions and requirements for businesses that have received financial assistance through the PPP. It serves as a mechanism to ensure that funds are allocated responsibly and that recipients comply with federal regulations. Understanding this list is essential for any business owner seeking clarity on their obligations.

In this article, we will delve into the intricacies of the warrant list for PPP loans, exploring its purpose, implications, and how it impacts businesses. Whether you're a business owner, accountant, or simply interested in learning more about PPP loans, this guide aims to provide valuable insights into this critical topic.

Read also:Meacutelanie Joly And Justin Trudeau Relationship A Deep Dive Into Their Bond

Table of Contents

- What is PPP Loan?

- Definition of Warrant List for PPP Loan

- Why the Warrant List Matters

- Eligibility Criteria for PPP Loans

- How to Check the Warrant List

- Consequences of Violating the Warrant List

- Tips to Avoid Violations

- Common Mistakes to Avoid

- Case Studies: Real-Life Examples

- The Future of PPP Loans

What is PPP Loan?

The Paycheck Protection Program (PPP) is a loan program initiated by the U.S. government to assist small businesses and self-employed individuals during times of financial distress. This program was originally introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in 2020. PPP loans are designed to help businesses retain their workforce and cover essential operational expenses.

Key Features of PPP Loans

- Eligible businesses can receive up to $10 million in funding.

- Loans may be forgiven if specific conditions are met, such as maintaining employee headcount and wages.

- Loan proceeds must be used for payroll costs, rent, utilities, and interest on existing debt obligations.

Understanding the structure and purpose of PPP loans is fundamental to navigating the warrant list effectively. The warrant list acts as a safeguard to ensure that businesses adhere to the rules and regulations governing these loans.

Definition of Warrant List for PPP Loan

The warrant list for PPP loan refers to a comprehensive document maintained by regulatory authorities that outlines the terms, conditions, and compliance requirements for businesses that have received PPP funding. This list serves as a legal agreement between the borrower and the Small Business Administration (SBA), ensuring that the funds are used for their intended purposes.

Key aspects of the warrant list include:

- Details of the loan agreement, including repayment terms and interest rates.

- Compliance guidelines that businesses must follow to qualify for loan forgiveness.

- Penalties for non-compliance or misuse of funds.

Why the Warrant List Matters

The warrant list for PPP loan plays a pivotal role in maintaining transparency and accountability in the distribution of federal funds. By adhering to the warrant list, businesses can avoid legal repercussions and ensure that their financial operations remain compliant with federal regulations.

Some reasons why the warrant list is important include:

Read also:Steve Harvey Sad News Today And The Legacy Of A Comedy Legend

- It provides a clear framework for businesses to follow when utilizing PPP funds.

- It helps prevent fraud and misuse of funds, protecting both borrowers and taxpayers.

- It ensures that businesses can maximize their chances of loan forgiveness by meeting all necessary criteria.

Eligibility Criteria for PPP Loans

Not all businesses qualify for PPP loans. To be eligible, businesses must meet specific criteria outlined by the SBA. These criteria include:

- Being a small business with fewer than 500 employees.

- Experiencing financial hardship due to unforeseen circumstances, such as a global pandemic.

- Using loan proceeds for eligible expenses, such as payroll, rent, and utilities.

Additional Requirements

Businesses must also provide accurate documentation to support their loan application. This includes payroll records, tax forms, and other relevant financial statements. Ensuring compliance with these requirements is essential for a successful PPP loan application.

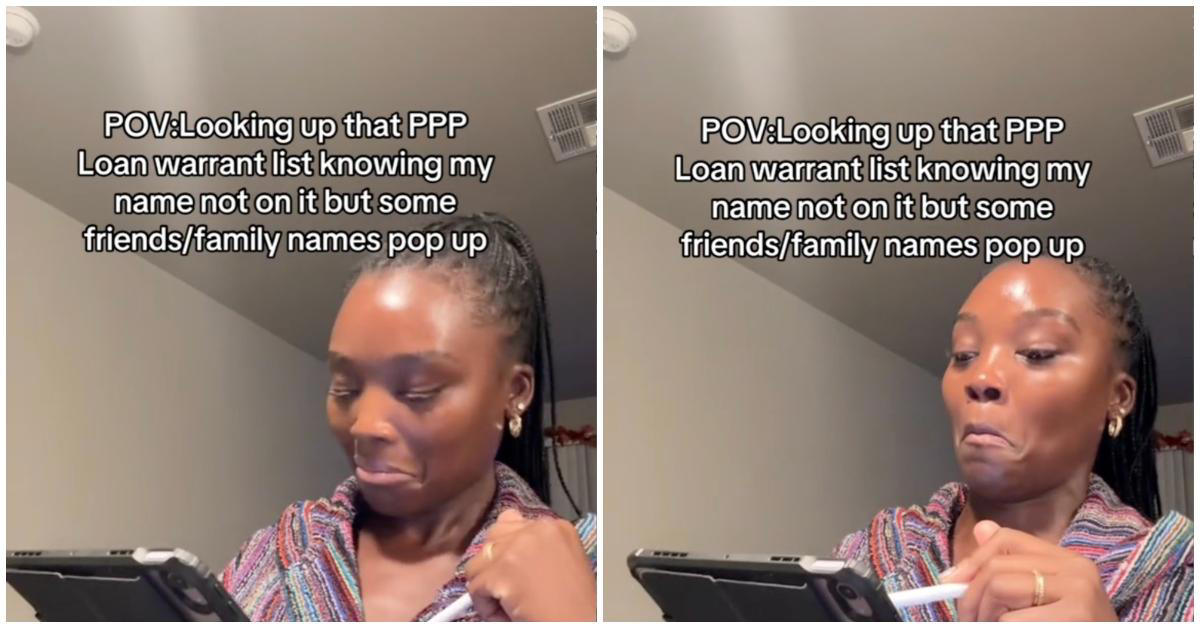

How to Check the Warrant List

Businesses that have received PPP loans can check the warrant list to ensure they are in compliance with all necessary regulations. This process involves accessing official resources provided by the SBA and verifying the terms of their loan agreement.

Steps to Check the Warrant List

- Visit the official SBA website for PPP loan resources.

- Review the documentation provided with your loan agreement.

- Contact your lender if you have questions about specific terms or conditions.

Consequences of Violating the Warrant List

Failure to comply with the warrant list for PPP loan can result in severe consequences for businesses. These consequences may include:

- Fines and penalties for misusing funds or failing to meet compliance requirements.

- Loss of eligibility for loan forgiveness, requiring full repayment of the loan.

- Potential legal action if fraudulent activities are discovered.

Protecting Your Business

To avoid these consequences, businesses should prioritize understanding and adhering to the warrant list. Regular audits and consultations with financial advisors can help ensure compliance and minimize risks.

Tips to Avoid Violations

Here are some practical tips for businesses to avoid violations of the warrant list for PPP loan:

- Keep detailed records of all expenses covered by PPP funds.

- Regularly review the terms of your loan agreement to ensure ongoing compliance.

- Seek professional advice from accountants or legal experts familiar with PPP regulations.

Common Mistakes to Avoid

Businesses often make mistakes when managing PPP loans. Some common errors include:

- Using loan proceeds for ineligible expenses.

- Failing to maintain accurate records of fund usage.

- Not understanding the forgiveness process and its requirements.

How to Avoid These Mistakes

By staying informed and following best practices, businesses can avoid these common pitfalls. Regular communication with lenders and adherence to SBA guidelines are key to ensuring successful PPP loan management.

Case Studies: Real-Life Examples

Examining real-life case studies can provide valuable insights into how businesses have navigated the warrant list for PPP loans. Here are two examples:

Case Study 1: Small Restaurant Chain

A small restaurant chain successfully utilized PPP funds to retain its workforce during a challenging period. By adhering to the warrant list and maintaining meticulous records, the business qualified for full loan forgiveness.

Case Study 2: Retail Store

A retail store faced penalties for misusing PPP funds after failing to comply with the warrant list. This case highlights the importance of understanding and following all regulatory requirements.

The Future of PPP Loans

The Paycheck Protection Program continues to evolve, with ongoing discussions about its future direction. As the economic landscape changes, businesses must remain vigilant in understanding and adapting to new regulations and guidelines.

Staying informed about updates to the warrant list for PPP loan is essential for long-term success. By maintaining compliance and leveraging available resources, businesses can position themselves for financial stability in the years to come.

Conclusion

In conclusion, the warrant list for PPP loan is a critical component of the Paycheck Protection Program. By understanding its purpose, requirements, and implications, businesses can ensure compliance and maximize their chances of success. We encourage readers to:

- Review the warrant list regularly to stay updated on regulatory changes.

- Seek professional guidance when navigating complex PPP loan requirements.

- Share this article with others who may benefit from its insights.

We invite you to leave comments or questions below, and don't hesitate to explore other articles on our website for additional information on financial topics.

Data sources and references:

- U.S. Small Business Administration (SBA) official website.

- Coronavirus Aid, Relief, and Economic Security (CARES) Act documentation.

- Financial industry publications and reports.