Monzo is a digital bank that has taken the financial world by storm, offering innovative services that cater to modern banking needs. In a world where convenience and accessibility are paramount, Monzo has positioned itself as a leader in the fintech industry. With its user-friendly app and transparent fee structures, Monzo has become a go-to choice for millions of customers worldwide.

Founded in 2015, Monzo has disrupted traditional banking by introducing a new way of managing finances. Unlike traditional banks, Monzo operates entirely online, eliminating the need for physical branches and offering round-the-clock customer support. This approach aligns perfectly with the fast-paced lifestyle of today's tech-savvy individuals.

As we delve deeper into this article, you'll discover how Monzo works, its key features, and why it has become such a popular choice for both personal and business banking. Whether you're considering opening an account or simply curious about the fintech revolution, this guide will provide you with all the information you need to make an informed decision.

Read also:Ted Bundy Daughter Unveiling The Truth Behind The Controversial Legacy

Table of Contents

- What is Monzo?

- Monzo's History and Background

- Key Features of Monzo

- Benefits of Using Monzo

- Monzo's Pricing Plans

- Security and Privacy Features

- Monzo vs. Traditional Banks

- Monzo for Businesses

- Frequently Asked Questions About Monzo

- Conclusion

What is Monzo?

Monzo is a digital bank that provides customers with a wide range of financial services through its mobile app. It offers current accounts, savings options, and business accounts, all designed to be easily accessible and user-friendly. Monzo's mission is to simplify banking for its customers, offering transparency and innovation in every aspect of its services.

Monzo's Vision and Mission

Monzo's vision is to create a world where banking is simple, transparent, and accessible to everyone. The company strives to eliminate hidden fees, complex terms, and unnecessary bureaucracy that often plague traditional banking systems. By focusing on customer satisfaction and leveraging technology, Monzo aims to revolutionize the way people manage their finances.

Some of the key aspects of Monzo's mission include:

- Providing real-time updates on transactions

- Offering budgeting tools to help users manage their money

- Ensuring a seamless user experience across all platforms

Monzo's History and Background

Monzo was founded in 2015 by Tom Blomfield, Jason Bates, Gary Tillett, and Paul Rippon. The company started as a prepaid card provider but quickly evolved into a full-fledged digital bank. In 2017, Monzo received its banking license from the UK Financial Conduct Authority (FCA), allowing it to offer a broader range of financial services.

Key Milestones in Monzo's Journey

Throughout its history, Monzo has achieved several milestones that have solidified its position in the fintech industry. Some of these milestones include:

- Launching its current account service in 2018

- Expanding its services to include savings accounts and joint accounts

- Introducing Monzo for Business to cater to small and medium-sized enterprises

Key Features of Monzo

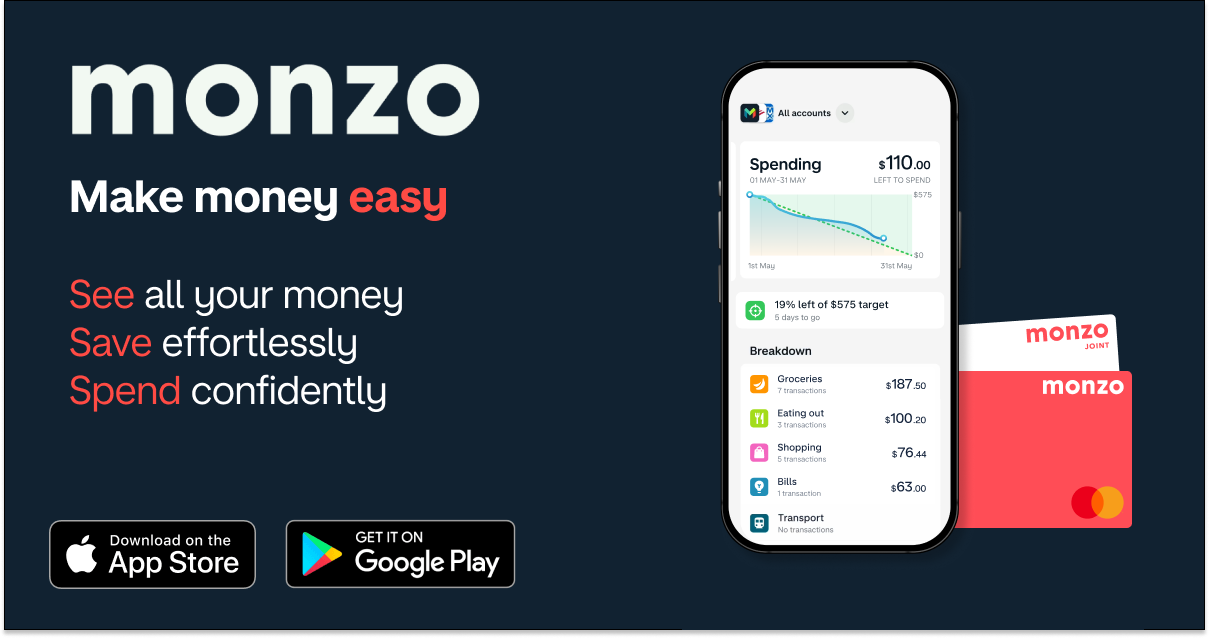

Monzo offers a variety of features that make it stand out from traditional banks. These features are designed to enhance the user experience and provide customers with greater control over their finances.

Read also:Rose Bundy The Rising Star Of The Entertainment World

Real-Time Transaction Alerts

One of the standout features of Monzo is its ability to provide real-time transaction alerts. Whenever you make a purchase or receive a payment, Monzo instantly updates your account balance and sends a notification to your mobile device. This feature helps users keep track of their spending and avoid unexpected overdraft fees.

Customizable Spending Limits

Monzo allows users to set spending limits for different categories, such as groceries, entertainment, and travel. This feature helps users stay within their budget and avoid overspending. Additionally, Monzo provides detailed insights into spending habits, enabling users to make informed financial decisions.

Benefits of Using Monzo

There are numerous benefits to using Monzo as your primary banking provider. From its innovative features to its commitment to transparency, Monzo offers a unique banking experience that caters to the needs of modern consumers.

No Hidden Fees

Monzo prides itself on its transparent fee structure, ensuring that customers are aware of any charges they may incur. Unlike traditional banks, Monzo does not charge hidden fees for services such as account maintenance or ATM withdrawals abroad. This transparency helps users avoid unexpected charges and manage their finances more effectively.

Customer-Centric Approach

Monzo prioritizes customer satisfaction by offering round-the-clock support through its mobile app. Users can easily contact Monzo's customer service team via chat or phone, ensuring that any issues are resolved promptly. This customer-centric approach has earned Monzo a loyal following and a reputation for excellence in service.

Monzo's Pricing Plans

Monzo offers several pricing plans to cater to different customer needs. These plans include the free Monzo Standard account, the Monzo Plus account, and the Monzo Premium account. Each plan offers unique benefits and features, allowing users to choose the option that best suits their financial requirements.

Monzo Standard

The Monzo Standard account is free to use and includes all the essential features of Monzo's service. Users can enjoy real-time transaction alerts, customizable spending limits, and access to Monzo's customer support team without incurring any additional charges.

Monzo Plus

For a monthly fee of £5, the Monzo Plus account offers additional benefits such as travel insurance, phone insurance, and discounted currency exchange rates. This plan is ideal for users who frequently travel or require extra protection for their personal belongings.

Security and Privacy Features

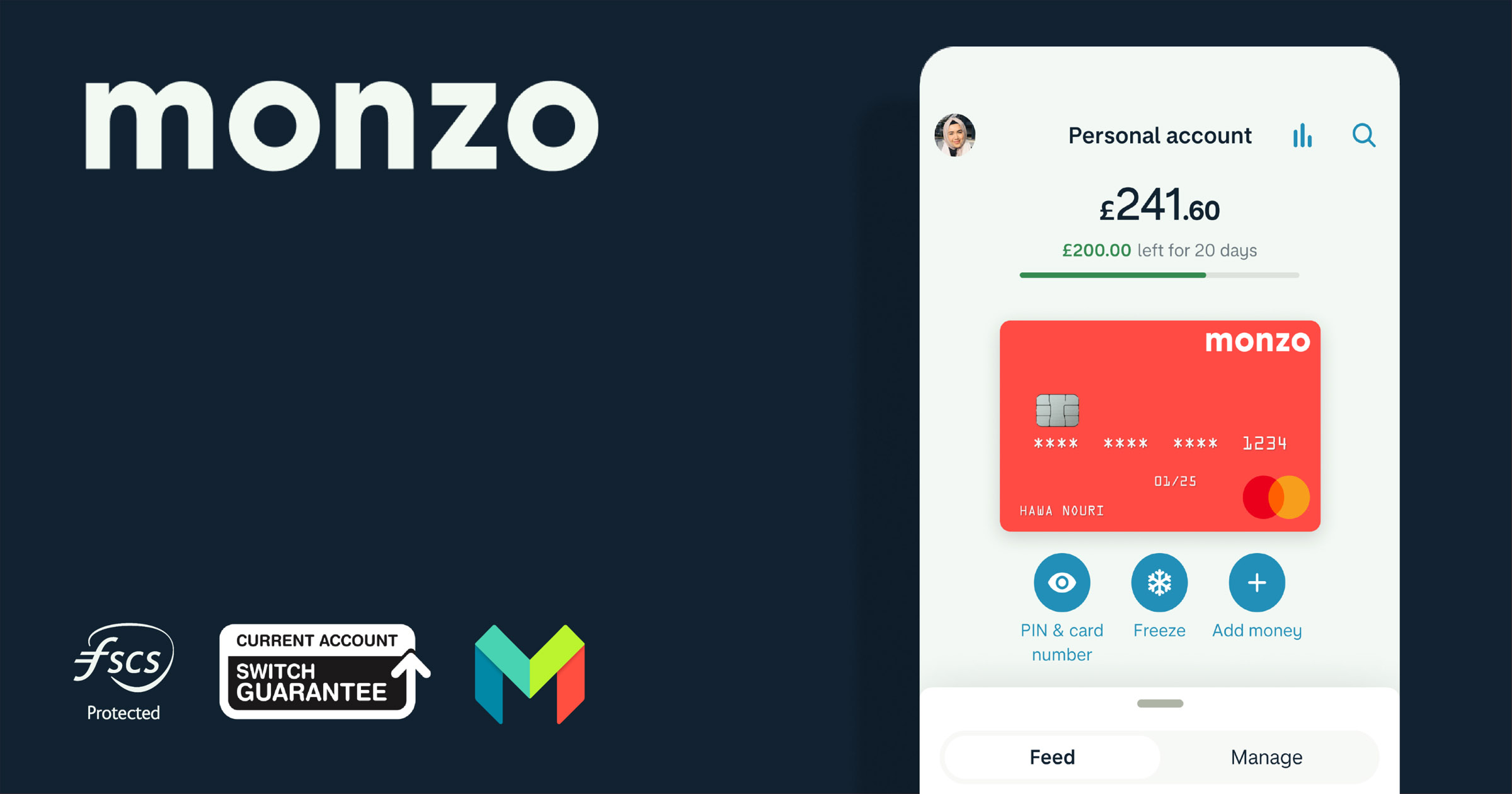

Monzo places a strong emphasis on security and privacy, ensuring that its customers' data is protected at all times. The company employs advanced encryption techniques and two-factor authentication to safeguard user information and prevent unauthorized access.

Data Encryption

Monzo uses industry-standard encryption protocols to protect sensitive data, such as account information and transaction history. This ensures that even if a hacker gains access to Monzo's systems, they will not be able to decipher the encrypted data.

Two-Factor Authentication

Monzo requires users to enable two-factor authentication (2FA) for added security. This feature ensures that only authorized users can access their accounts, even if their login credentials are compromised.

Monzo vs. Traditional Banks

When comparing Monzo to traditional banks, it's clear that Monzo offers several advantages that make it a more attractive option for modern consumers. From its innovative features to its transparent fee structure, Monzo provides a banking experience that is both convenient and cost-effective.

Convenience

Monzo's mobile-first approach allows users to manage their finances from anywhere at any time. Traditional banks, on the other hand, often require customers to visit physical branches or wait for business hours to resolve issues, making the process less convenient.

Cost-Effectiveness

Monzo's transparent fee structure eliminates hidden charges and unexpected fees, making it a more cost-effective option for many users. Traditional banks, in contrast, often charge fees for services such as account maintenance, ATM withdrawals, and currency exchanges.

Monzo for Businesses

In addition to its personal banking services, Monzo offers a range of solutions for businesses. Monzo for Business is designed to help small and medium-sized enterprises manage their finances more effectively, providing features such as multi-user access, expense tracking, and invoicing tools.

Multi-User Access

Monzo for Business allows multiple users to access the same account, making it easier for teams to collaborate and manage finances. This feature is particularly useful for companies with multiple employees who need to monitor and manage company funds.

Expense Tracking

Monzo's expense tracking tools help businesses keep track of their spending and categorize expenses for accounting purposes. This feature simplifies the process of preparing financial statements and ensures that businesses remain compliant with tax regulations.

Frequently Asked Questions About Monzo

Here are some common questions users have about Monzo, along with their answers:

How Do I Open a Monzo Account?

Opening a Monzo account is simple and can be done entirely through the Monzo mobile app. Users need to download the app, complete the registration process, and verify their identity using a photo ID.

Is Monzo Available in My Country?

Monzo is currently available in the UK and select European countries. The company is working on expanding its services to other regions, but availability may vary depending on local regulations.

Conclusion

In conclusion, Monzo is a revolutionary digital bank that offers a modern approach to personal and business banking. With its innovative features, transparent fee structure, and commitment to customer satisfaction, Monzo has become a popular choice for millions of users worldwide.

We encourage you to explore Monzo's services and discover how they can benefit your financial management. If you have any questions or comments, feel free to leave them below. Additionally, don't forget to share this article with your friends and family to help them learn more about Monzo and the fintech revolution.