The Ohio State Employee Retirement System (Ohio SERS) is one of the most important financial institutions for public employees in Ohio. Whether you're a current state employee, a retiree, or someone interested in understanding public retirement systems, Ohio SERS plays a crucial role in securing the financial future of its members. In this article, we will explore everything you need to know about Ohio SERS, from its history and benefits to how it impacts members' lives.

Retirement planning is a significant aspect of everyone's life, and having a reliable system like Ohio SERS ensures that public employees can enjoy financial security during their retirement years. This guide will break down the complexities of the system, making it easier for you to understand how it works and how it benefits its members.

As we delve deeper into Ohio SERS, we will also explore various aspects such as eligibility, contribution rates, benefit calculations, and more. By the end of this article, you will have a comprehensive understanding of Ohio SERS and how it contributes to the financial stability of its members.

Read also:Harry Enten Wife A Comprehensive Look Into His Personal Life

Table of Contents

- Introduction to Ohio SERS

- History of Ohio SERS

- Eligibility Requirements

- Benefits of Ohio SERS

- Understanding Contributions

- Retirement Planning with Ohio SERS

- How Retirement Benefits Are Calculated

- Taxes and Ohio SERS

- Resources for Ohio SERS Members

- The Future of Ohio SERS

Introduction to Ohio SERS

The Ohio State Employee Retirement System (Ohio SERS) is a defined benefit pension plan designed to provide retirement security for state employees in Ohio. Established to support public workers, Ohio SERS plays a vital role in ensuring that employees have a stable financial future after their working years.

What is Ohio SERS?

Ohio SERS is a pension system that offers retirement benefits to employees of the state of Ohio. It is a defined benefit plan, meaning that members receive a guaranteed monthly income during their retirement based on their years of service and salary history. This system is essential for public employees who rely on it for their financial stability after retirement.

Why is Ohio SERS Important?

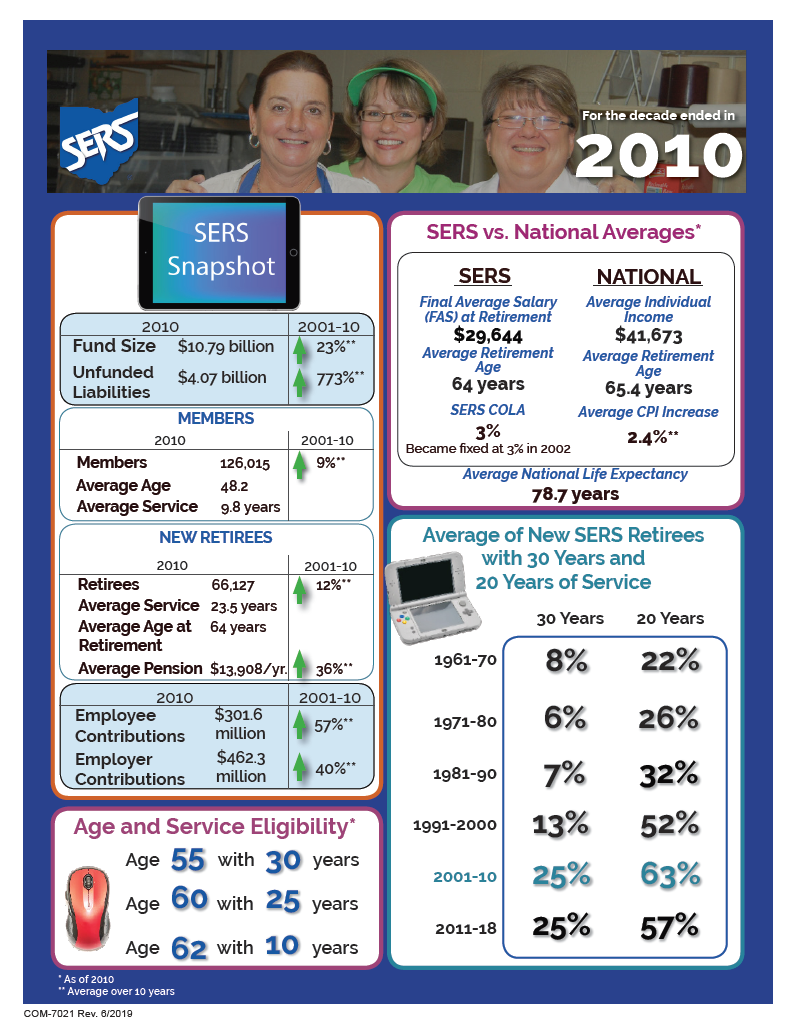

Ohio SERS is important because it provides a safety net for state employees, ensuring they have a predictable and stable income during retirement. It also helps attract and retain talented individuals who want the security of a reliable retirement plan. Additionally, Ohio SERS contributes significantly to the state's economy by managing billions of dollars in assets and providing benefits to thousands of retirees.

History of Ohio SERS

Established in 1937, Ohio SERS has a rich history of serving public employees in the state. Initially created to provide retirement benefits for state employees, it has evolved over the years to include additional benefits and services. Today, Ohio SERS is one of the largest retirement systems in Ohio, managing assets worth billions of dollars.

Key Milestones in Ohio SERS History

- 1937: Ohio SERS is established to provide retirement benefits for state employees.

- 1950s: The system expands to include additional benefits such as disability and death benefits.

- 1980s: Ohio SERS introduces investment options to enhance the growth of its assets.

- 2000s: The system continues to adapt to changing economic conditions and member needs.

Eligibility Requirements

Not all employees are eligible to join Ohio SERS. To become a member, certain criteria must be met. Understanding these requirements is essential for anyone considering employment with the state of Ohio.

Who Can Join Ohio SERS?

Eligibility for Ohio SERS typically includes:

Read also:Melissa Oneil Weight A Comprehensive Guide

- State employees working in Ohio.

- Employees of participating agencies and institutions.

- Certain part-time employees who meet specific criteria.

Enrollment Process

Once eligibility is confirmed, employees must complete the enrollment process. This involves filling out necessary forms and ensuring all required documentation is submitted. It is important to enroll promptly to start accruing benefits.

Benefits of Ohio SERS

Ohio SERS offers a variety of benefits that make it an attractive option for state employees. These benefits go beyond just retirement income, providing comprehensive support for members throughout their careers and into retirement.

Retirement Benefits

Members of Ohio SERS receive a monthly retirement benefit based on their years of service and salary history. This benefit is designed to provide a stable income during retirement, ensuring financial security for members.

Additional Benefits

Besides retirement income, Ohio SERS offers additional benefits such as:

- Disability benefits for members who become unable to work due to illness or injury.

- Death benefits for beneficiaries of deceased members.

- Survivor benefits to support dependents after a member's passing.

Understanding Contributions

To receive benefits from Ohio SERS, members must contribute a portion of their salary to the system. Understanding how contributions work is essential for managing finances effectively while working and planning for retirement.

Contribution Rates

Contribution rates for Ohio SERS vary depending on factors such as the member's job classification and years of service. Typically, members contribute a percentage of their salary, which is matched by their employer. These contributions are invested and grow over time, contributing to the member's retirement benefits.

Tax Implications of Contributions

Contributions to Ohio SERS are generally tax-deductible, meaning they reduce the member's taxable income. However, it is important to consult with a tax professional to understand the full implications of contributions on your tax situation.

Retirement Planning with Ohio SERS

Planning for retirement is a crucial aspect of financial management. Ohio SERS provides tools and resources to help members plan effectively for their post-working years.

Retirement Planning Tools

Ohio SERS offers various tools and resources to assist members with retirement planning, including:

- Online calculators to estimate retirement benefits.

- Workshops and seminars on retirement planning.

- Personalized consultations with retirement planning experts.

Factors to Consider in Retirement Planning

When planning for retirement with Ohio SERS, members should consider factors such as:

- Years of service and salary history.

- Expected retirement age and lifestyle needs.

- Other sources of retirement income, such as Social Security or personal savings.

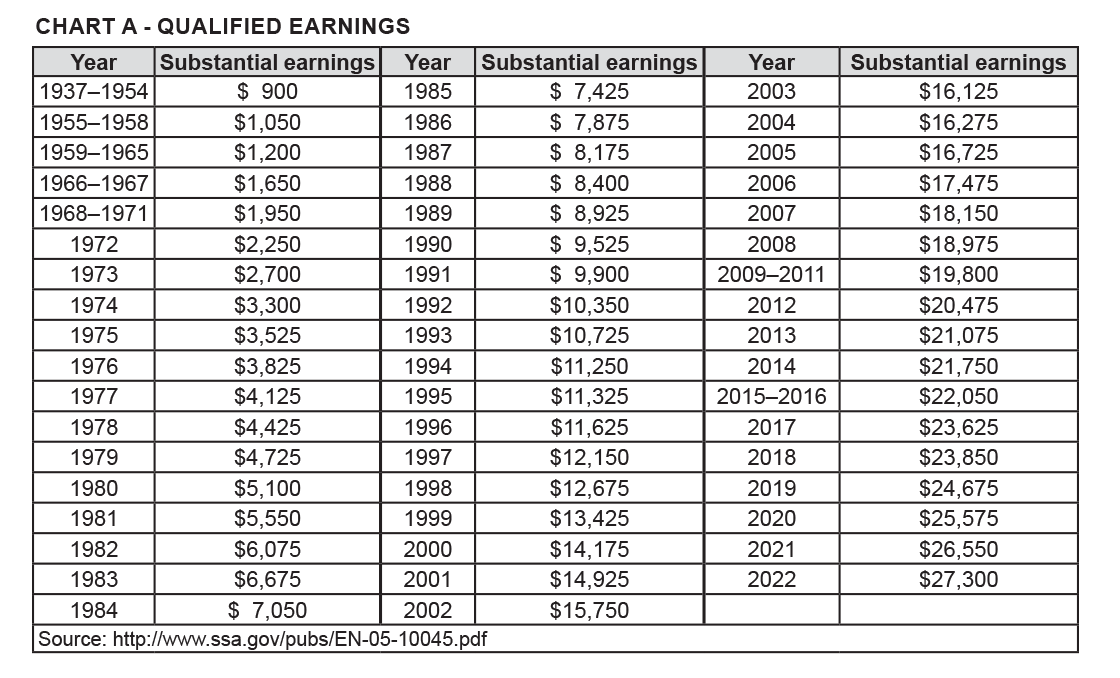

How Retirement Benefits Are Calculated

Understanding how retirement benefits are calculated is essential for members of Ohio SERS. The formula used takes into account several factors to determine the amount of monthly income a member will receive during retirement.

Key Factors in Benefit Calculation

The main factors in calculating retirement benefits include:

- Years of service with Ohio SERS.

- Final average salary, typically based on the highest consecutive years of earnings.

- Age at retirement.

Example of Benefit Calculation

For example, a member with 30 years of service and a final average salary of $50,000 might receive a monthly benefit calculated as follows:

Monthly Benefit = (Years of Service × Final Average Salary × Benefit Multiplier)

Taxes and Ohio SERS

Taxes play a significant role in how retirement benefits from Ohio SERS are managed. Understanding the tax implications of receiving benefits is crucial for financial planning.

Taxable Portions of Benefits

Some portions of Ohio SERS benefits may be subject to federal and state taxes. Members should consult with a tax professional to understand how taxes will affect their retirement income.

Strategies for Tax Management

To manage taxes effectively, members can consider strategies such as:

- Deferring some benefits to reduce taxable income in a given year.

- Maximizing contributions to other tax-advantaged retirement accounts.

Resources for Ohio SERS Members

Ohio SERS provides a wealth of resources to help members navigate the system and make informed decisions about their retirement.

Online Resources

Members can access a variety of online resources, including:

- An online portal for managing accounts and viewing benefit information.

- Webinars and educational materials on retirement planning.

Customer Support

Ohio SERS offers customer support services to assist members with any questions or concerns they may have. Members can reach out via phone, email, or in-person visits to regional offices.

The Future of Ohio SERS

As the needs of public employees continue to evolve, Ohio SERS is committed to adapting and improving its services. The system is constantly evaluating its policies and procedures to ensure it remains a reliable source of retirement security for its members.

Innovations and Improvements

Future innovations may include:

- Enhanced digital tools for managing accounts and planning retirement.

- Expanded benefits to address the changing needs of public employees.

Commitment to Members

Ohio SERS remains dedicated to providing excellent service and support to its members. By staying informed about changes and updates, members can ensure they are making the most of their retirement benefits.

Conclusion

In conclusion, Ohio SERS is a vital institution for state employees in Ohio, providing essential retirement benefits and supporting members throughout their careers. By understanding how the system works, members can make informed decisions about their financial futures and enjoy peace of mind during their retirement years.

We invite you to share your thoughts and experiences with Ohio SERS in the comments below. For more information on retirement planning and financial security, explore our other articles and resources. Together, we can ensure a stable and prosperous future for all.