FTB Tax Board is an essential entity that manages tax-related issues for individuals and businesses. Whether you're a resident or a business owner, understanding the role and responsibilities of the FTB Tax Board can significantly impact your financial health. This article will delve into the nuances of the FTB Tax Board, providing you with actionable insights to manage your tax obligations effectively.

The FTB Tax Board plays a pivotal role in ensuring compliance with tax laws and regulations. By understanding its functions, you can better prepare for audits, file your taxes accurately, and avoid potential penalties. This guide is designed to give you a complete overview of the FTB Tax Board, ensuring you are well-informed and equipped to handle any tax-related matters.

In this article, we will explore the history, responsibilities, and procedures of the FTB Tax Board. Additionally, we will provide practical advice and tips to help you navigate through the complexities of tax regulations. Whether you're a first-time filer or a seasoned business owner, this guide will serve as a valuable resource.

Read also:Colin Jost And Michael Che Friendship A Deep Dive Into Their Bond And Impact

Table of Contents

- Overview of FTB Tax Board

- History and Evolution of FTB Tax Board

- Key Functions of FTB Tax Board

- FTB Tax Board Filing Process

- Common Issues with FTB Tax Board

- Audit Procedures by FTB Tax Board

- Penalties and Compliance

- Resources for FTB Tax Board

- Tips for Dealing with FTB Tax Board

- Conclusion and Call to Action

Overview of FTB Tax Board

The FTB Tax Board, also known as the Franchise Tax Board, is a state agency responsible for administering California's tax laws. Its primary role is to ensure that all residents and businesses comply with tax regulations and pay their fair share. The FTB Tax Board handles various tax types, including personal income tax, corporate taxes, and partnership taxes.

Role in Tax Collection

One of the critical responsibilities of the FTB Tax Board is tax collection. It ensures that all taxpayers file their returns accurately and on time. The agency also manages the distribution of tax revenues to state and local governments, supporting essential services such as education, healthcare, and infrastructure.

Impact on Residents

For California residents, understanding the FTB Tax Board is crucial. It directly affects your tax liabilities, refund processes, and overall financial well-being. By staying informed about the FTB Tax Board's policies and procedures, you can avoid unnecessary complications and ensure compliance with tax laws.

History and Evolution of FTB Tax Board

The FTB Tax Board was established to streamline tax administration in California. Over the years, it has evolved to address the changing needs of taxpayers and the state's financial requirements. Initially focused on personal income tax, the FTB Tax Board now oversees a wide range of tax-related activities.

Read also:Scratch And Dent Lowes Your Ultimate Guide To Affordable Home Improvement Solutions

Key Milestones

- Establishment of the FTB Tax Board in the early 20th century

- Expansion of responsibilities to include corporate and partnership taxes

- Implementation of digital systems for easier tax filing and processing

Modernization Efforts

In recent years, the FTB Tax Board has embraced modern technology to enhance its services. Online platforms and digital tools have made it easier for taxpayers to file their returns, track their refunds, and resolve issues promptly. These advancements reflect the agency's commitment to improving taxpayer experiences while maintaining compliance.

Key Functions of FTB Tax Board

The FTB Tax Board performs several essential functions to ensure the smooth operation of California's tax system. These functions include tax collection, enforcement, and taxpayer assistance. Each function plays a vital role in maintaining the integrity of the tax system.

Tax Collection

Tax collection is the core function of the FTB Tax Board. It involves processing tax returns, calculating tax liabilities, and distributing revenues to appropriate entities. The agency uses advanced systems to ensure accuracy and efficiency in tax collection processes.

Enforcement

Enforcement is another critical function of the FTB Tax Board. It involves monitoring taxpayer compliance, identifying discrepancies, and taking appropriate actions against non-compliance. Through audits and investigations, the agency ensures that all taxpayers adhere to the laws and regulations.

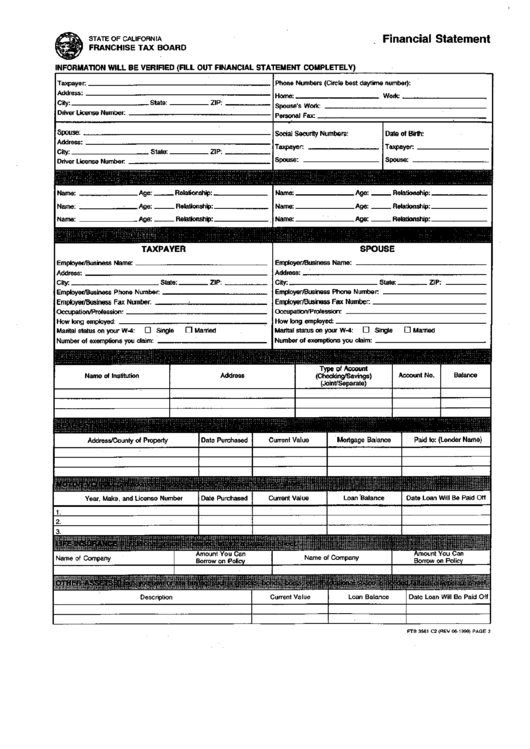

FTB Tax Board Filing Process

Filing taxes with the FTB Tax Board can seem daunting, but understanding the process can simplify the experience. The agency provides various methods for filing taxes, including online platforms, mail-in forms, and third-party services.

Steps to File Taxes

- Gather all necessary documents, such as W-2s, 1099s, and receipts

- Choose a filing method: online, mail, or third-party service

- Complete the required forms accurately and submit them by the deadline

- Track your refund or payment status using the FTB Tax Board's online tools

Common Filing Mistakes

Avoiding common filing mistakes can save you time and prevent unnecessary complications. Some of the most common mistakes include errors in personal information, missing documents, and incorrect calculations. Double-checking your forms before submission can help ensure a smooth filing process.

Common Issues with FTB Tax Board

Despite its efforts to streamline tax processes, the FTB Tax Board faces several common issues that taxpayers may encounter. Understanding these issues can help you address them effectively and avoid potential penalties.

Delayed Refunds

One of the most common issues is delayed refunds. This can occur due to errors in filing, missing documentation, or audits. The FTB Tax Board provides resources to help taxpayers track their refund status and resolve issues promptly.

Non-Compliance Penalties

Non-compliance with tax laws can result in penalties and interest charges. The FTB Tax Board imposes penalties for late filings, underpayments, and incorrect reporting. Staying informed about tax obligations and deadlines can help you avoid these penalties.

Audit Procedures by FTB Tax Board

Audits are a necessary part of the tax system, ensuring compliance and fairness. The FTB Tax Board conducts audits to verify the accuracy of tax returns and identify discrepancies. Understanding the audit procedures can help you prepare and respond appropriately.

Types of Audits

- Correspondence audits: conducted through mail or online communication

- Field audits: conducted in person at the taxpayer's location

- Office audits: conducted at the FTB Tax Board's office

Preparing for an Audit

Preparing for an audit involves gathering all necessary documents, reviewing your tax returns, and understanding the FTB Tax Board's requirements. Consulting with a tax professional can also provide valuable guidance and support during the audit process.

Penalties and Compliance

Compliance with tax laws is essential to avoid penalties and legal issues. The FTB Tax Board imposes penalties for various violations, including late filings, underpayments, and incorrect reporting. Understanding these penalties can help you stay compliant and protect your financial interests.

Penalty Structure

The FTB Tax Board's penalty structure is designed to encourage compliance while addressing non-compliance fairly. Penalties may include fines, interest charges, and additional assessments. In some cases, penalties can be waived or reduced if the taxpayer demonstrates reasonable cause or good faith efforts to comply.

Appealing Penalties

If you believe a penalty is unjust or unfair, you can appeal the decision through the FTB Tax Board's appeals process. Providing evidence and documentation to support your case can increase the likelihood of a favorable outcome.

Resources for FTB Tax Board

The FTB Tax Board offers a wealth of resources to assist taxpayers with their tax obligations. These resources include online tools, publications, and customer support services. Utilizing these resources can help you navigate the complexities of tax regulations and ensure compliance.

Online Tools

- FTB Tax Board's official website for filing and tracking

- Electronic Filing (e-File) options for convenience

- Refund status trackers and payment options

Publications

The FTB Tax Board publishes various guides and forms to assist taxpayers. These publications provide detailed information on tax laws, filing procedures, and compliance requirements. Staying updated with these resources can help you make informed decisions about your tax obligations.

Tips for Dealing with FTB Tax Board

Dealing with the FTB Tax Board can be challenging, but following these tips can make the process smoother and more efficient:

- Stay informed about tax laws and regulations

- File your taxes accurately and on time

- Keep detailed records of all tax-related documents

- Seek professional advice if needed

- Utilize the FTB Tax Board's resources and tools

Building a Positive Relationship

Building a positive relationship with the FTB Tax Board can benefit you in the long run. Responding promptly to communications, maintaining accurate records, and demonstrating compliance can help you avoid unnecessary complications and penalties.

Conclusion and Call to Action

In conclusion, the FTB Tax Board plays a vital role in California's tax system, ensuring compliance and fairness for all taxpayers. By understanding its functions, procedures, and resources, you can navigate tax obligations effectively and protect your financial well-being.

We encourage you to take action by reviewing your tax records, utilizing the FTB Tax Board's resources, and seeking professional advice if needed. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our site for more valuable insights.

Disclaimer: The information provided in this article is for educational purposes only. Always consult with a tax professional or legal advisor for specific advice related to your situation.